Managing Cash Flow for Businesses: A Key to Success

For any business, cash flow management is a crucial aspect of success that determines the financial health of the company. Simply put, cash flow refers to the amount of money that flows in and out of a business over a particular period of time. While the inflow of revenue is what most small business owners focus on, it is equally important to keep track of the outflows to ensure that the business stays in good financial shape.

Why Managing Cash Flow is Important

As a business owner, managing cash flow can help you in several ways. Here are the top reasons why managing your cash flow is essential:

1. Helps to Plan for the Future: A reliable cash flow forecast can help you plan your business finances for the upcoming months or years. It enables you to identify any potential cash flow gaps well in advance, giving you time to address them before they occur.

2. Improves Financial Stability: By managing cash flow effectively, you can improve your business’s financial stability. This provides you with greater flexibility in terms of taking on new business ventures, expanding the company, or even weathering an unexpected financial crisis.

3. Helps to Monitor Business Performance: Analyzing your cash flow statement can help you understand how your business is performing and identify areas of improvement. It can help you identify whether your business is generating enough income to cover all expenses and if not, which areas require trimming.

Tips for Managing Cash Flow

Here are some tips that can help you manage your business’s cash flow better:

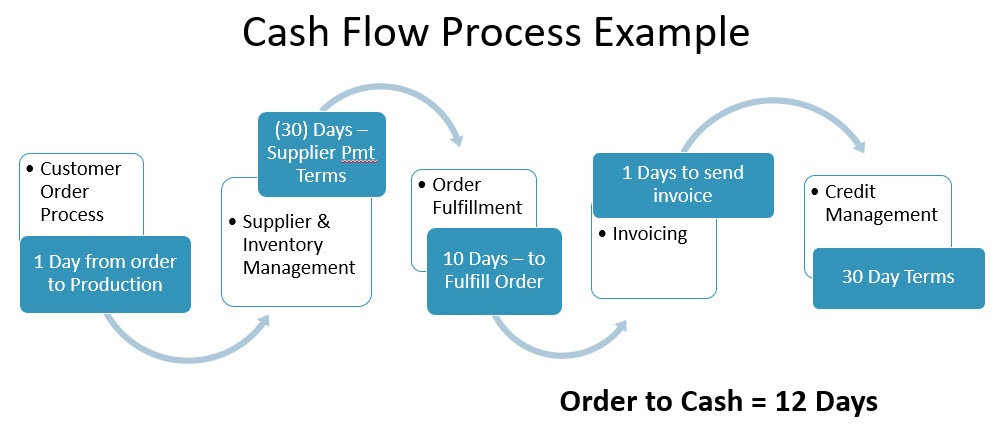

1. Develop a Cash Flow Forecast: Preparing a cash flow forecast is an essential step in managing your business finances. It helps you estimate your cash inflows and outflows, giving you a good idea of when money is coming in and when expenses are due.

2. Monitor Your Invoices: Late invoice payments can put a dent in your cash flow. Implementing a system to keep track of invoice payments and sending timely reminders can help reduce the risk of late payments.

3. Control Expenses: Keeping tabs on your spending can help you identify potential cost-saving opportunities. Sticking to a budget can help you maintain healthy cash flow and financial stability.

4. Manage Inventory: Overstocking or understocking can lead to cash flow issues. Managing your inventory levels can help you minimize wastage, improve efficiency and keep cash flow in check.

Conclusion

Managing cash flow is essential for any business, regardless of its size or industry. It requires effective planning, monitoring, and control to ensure smooth business operations and financial stability. By implementing the tips above, you can manage your cash flow effectively and grow your business with confidence.