In recent years, cryptocurrencies have emerged as a new and exciting alternative to traditional investments. With the rise of Bitcoin and other digital currencies, more and more people are curious about investing in this potentially high-reward market. However, as with any investment opportunity, there are pros and cons to consider before jumping in.

Pros of Crypto Investments:

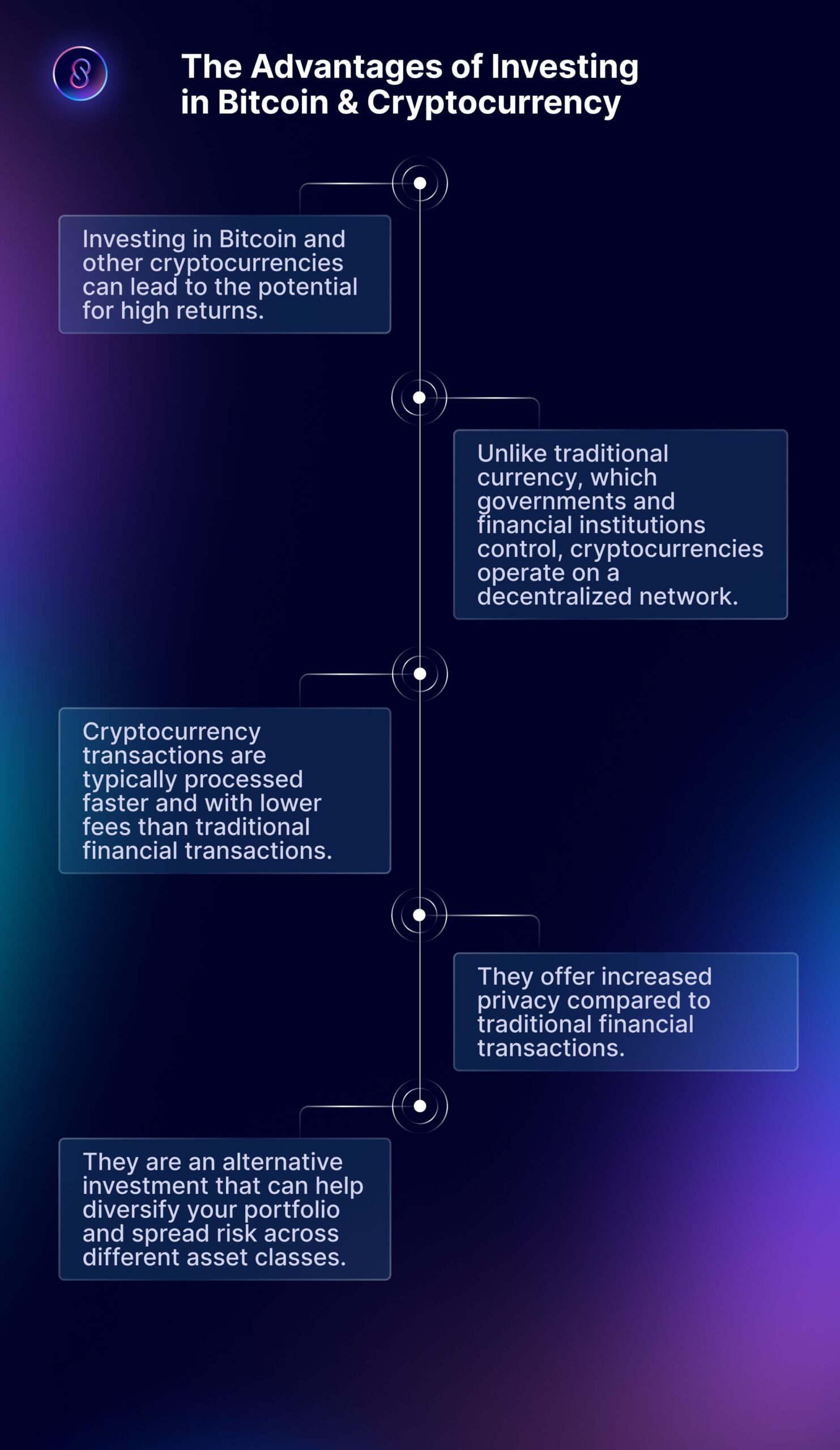

1. Potential for High Returns: One of the most attractive qualities of crypto investments is their potential for high returns. In recent years, Bitcoin has seen massive gains, with some investors making millions in profits. However, it’s essential to remember that these high returns also come with high risk.

2. Decentralization: Cryptocurrencies are decentralized, which means that they are not controlled by any central authority, such as a government or financial institution. This decentralization is one of the key selling points of cryptocurrencies and provides more financial autonomy to investors.

3. Anonymity: Unlike traditional investments, cryptocurrencies allow investors to remain anonymous. Cryptocurrency transactions do not require any personal information, which can be helpful for those who value privacy.

Cons of Crypto Investments:

1. High Volatility: One of the most significant drawbacks of crypto investments is their high volatility. The value of cryptocurrencies can fluctuate dramatically, even in a single day. This unpredictability can make it difficult to predict when to buy or sell, leading to potential losses.

2. Lack of Regulation: Cryptocurrencies are not regulated like traditional investment options, which can make them riskier. As a result, it’s important to do your research before investing, as there is a higher chance for scams or fraud.

3. Limited Acceptance: While the use of cryptocurrencies is growing, they are still not widely accepted by businesses and individuals as a legitimate form of payment. This limited acceptance makes it difficult to use cryptocurrencies in day-to-day transactions.

Conclusion:

While crypto investments can offer high rewards and financial autonomy, it’s important to consider the risks before investing. High volatility, lack of regulation, and limited acceptance are all factors to consider when deciding if crypto investments are right for you. As with any investment decision, it’s essential to research the market thoroughly and seek advice from a financial advisor. Whether to invest in cryptocurrencies or not is ultimately a decision that needs careful consideration, based on personal circumstances, risk tolerance, and financial goals.