Title: Maximizing Educational Funding: Tips and Strategies for Success

Introduction:

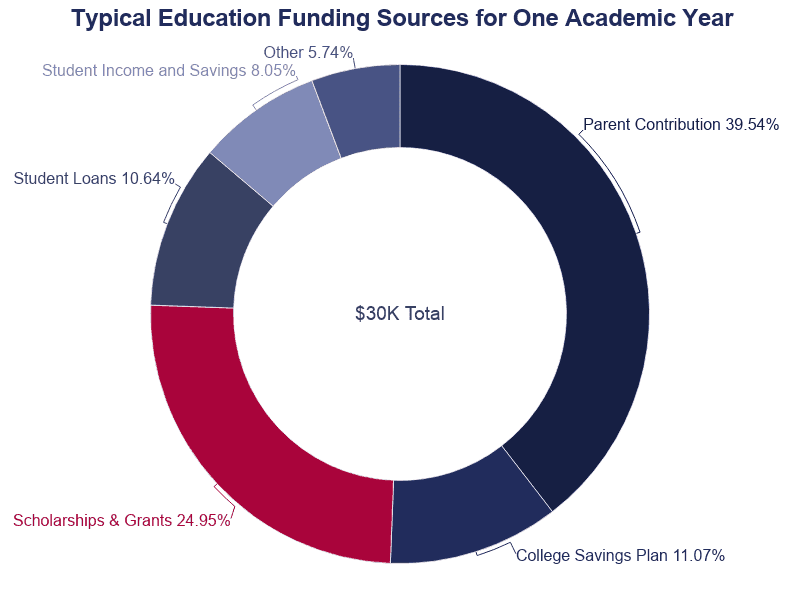

Investing in education is crucial for one’s future success. However, not everyone can afford a quality education due to financial constraints. In such cases, students often rely on financial aid or student loans to fund their education. But, identifying and maximizing educational funding sources can be challenging. That’s why we have compiled a list of tips and strategies to help you maximize your education funding.

1. Start with FAFSA:

The Free Application for Federal Student Aid (FAFSA) is the primary funding source for government-funded programs. It is the first step towards securing federal and state grants, work-study programs, and loans. Fill out the FAFSA as early as possible to ensure you receive the maximum amount of financial aid.

2. Look for other scholarships and grants:

Apart from FAFSA, look for specific grants and scholarships offered through various government organizations, private institutions, or non-profit organizations. Research online, career services, and your school’s financial aid office for resources that match your qualifications.

3. Consider Work-Study Programs:

The Federal Work-Study Program offers part-time jobs to students, helping them earn money while gaining work experience. Check with your school’s financial aid office to see if you are eligible for work-study programs.

4. Save on Textbooks:

Textbooks can be expensive, but there are ways to save money. Look for used textbooks, online discounts, or even rentals. Buy books only after confirming it is on the required reading list.

5. Take Advantage of Tax Credits:

There are several tax benefits available for students and their families, such as the Lifetime Learning Credit, American Opportunity Tax Credit, and Tuition and Fees Deduction. Consult with a tax professional to determine which credits apply to you.

6. Consider Community College:

Community colleges are often a cost-effective alternative to traditional four-year universities. Most community colleges offer a wide range of courses and degrees, transfer programs, and scholarships.

7. Be Financially Responsible:

It’s essential to develop responsible financial habits when attending school. This includes creating a budget, tracking expenses, and avoiding unnecessary debt. Limit credit card usage and prioritize spending on essential items.

Conclusion:

Maximizing your educational funding can help reduce the burden of student loan debt and help you focus on your studies. By following these tips and strategies and being financially responsible, you’ll be better equipped to succeed academically and financially. Remember to start early, stay organized, and always seek help from your school’s financial aid office.