Unlocking the Secrets of Educational Finance and Funding

If you’re a student, educator, or someone interested in the inner workings of the educational system, understanding the complexities of educational finance and funding is crucial. Educational institutions rely on a combination of public and private funding sources to support their operations, and these funds play a key role in shaping the quality and accessibility of education.

In this blog post, we will explore the secrets of educational finance, providing you with valuable insights into the various funding mechanisms and their implications. Whether you’re looking to secure funding for a project, understand how educational budgets are allocated, or simply gain a deeper understanding of this fascinating field, this post will serve as your ultimate guide.

1. Public Funding:

Public funding forms the backbone of educational finance in many countries. It typically comes from government budgets, tax revenues, and other sources. In order to understand how public funding affects educational institutions, we’ll dive into topics such as:

– Education expenditure: How much does the government spend on education, and how are these funds distributed among different levels (e.g., primary, secondary, tertiary)?

– Funding formulas: What are the mechanisms used to allocate public funds to schools, and what factors influence these formulas (e.g., student enrollment, socio-economic indicators)?

– Grant programs: Are there any specific grant programs available to educational institutions or individuals, and how can they be accessed? We’ll explore different types of grants, eligibility criteria, and their impact on education.

2. Private Funding:

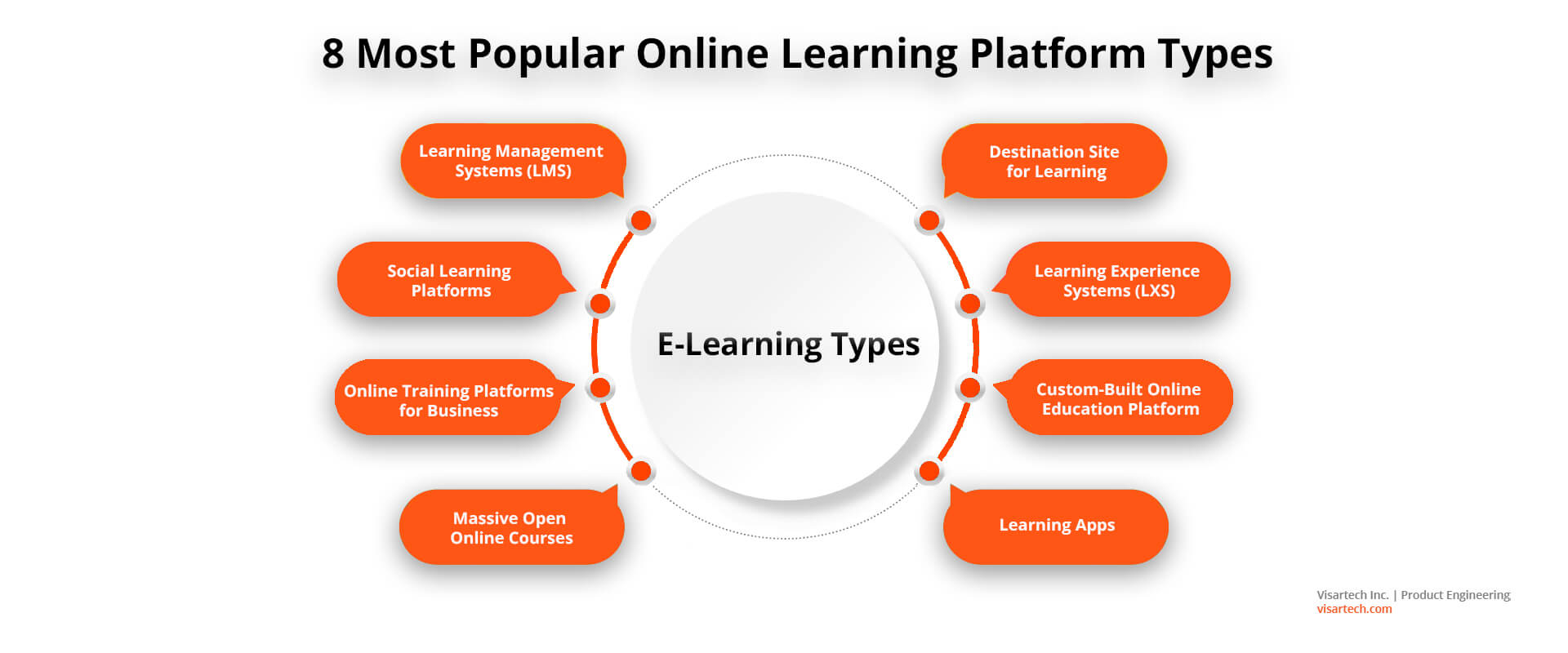

In addition to public funding, educational institutions often seek private funding from various sources. These could include philanthropic organizations, corporate sponsorships, donations from individuals, or even crowdfunding campaigns. In this section, we’ll cover:

– Donor contributions: How do philanthropic organizations and individuals contribute to educational finance, and what drives their decisions? We’ll examine the motivations behind such contributions and the impact they can have on shaping education.

– Corporate partnerships: What are the benefits and challenges of partnering with corporations for educational institutions? We’ll discuss examples of successful collaborations and the potential opportunities they offer.

– Crowdfunding: How can educators and students leverage the power of the internet to raise funds for specific educational projects or initiatives? We’ll explore popular crowdfunding platforms and provide tips for running a successful campaign.

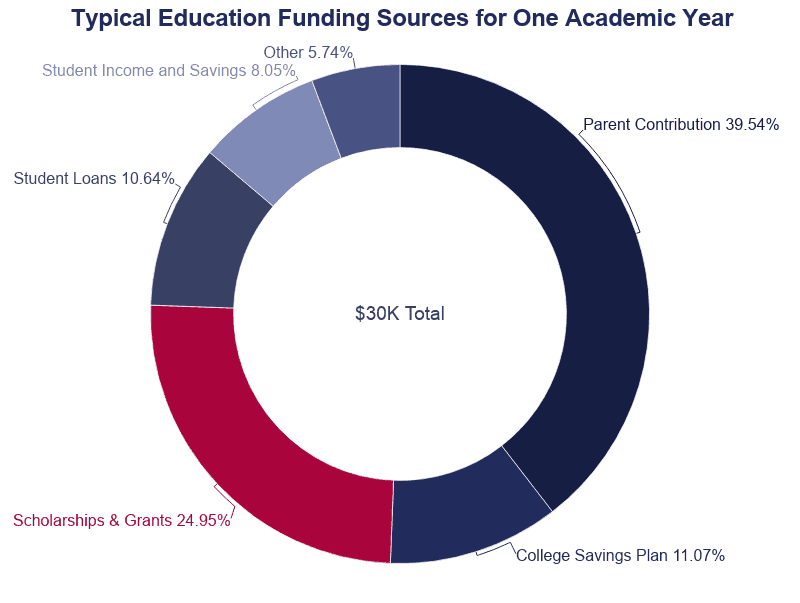

3. Grants and Scholarships:

Grants and scholarships provide an essential avenue of support for students pursuing their educational goals. Exploring this topic, we’ll address:

– Types of grants and scholarships: What are the different types of financial aid available to students, and how can they be accessed? We’ll discuss need-based grants, merit-based scholarships, and other forms of assistance.

– Eligibility requirements: What are the common eligibility criteria for grants and scholarships, and how can students increase their chances of receiving financial aid? We’ll provide practical tips for navigating the application process.

– Impact on educational access: How do grants and scholarships contribute to making education more accessible to marginalized communities and underprivileged students? We’ll examine the positive social impact of these funding mechanisms.

4. Budgeting and Financial Planning:

Understanding how educational institutions manage their finances is crucial for educators and administrators. In this section, we’ll explore:

– Budgeting process: How do educational institutions develop and manage their budgets? We’ll outline the key steps involved in budget preparation, including forecasting, prioritization, and monitoring.

– Cost optimization: How can educators and administrators identify opportunities to reduce costs without compromising the quality of education? We’ll provide practical cost-saving strategies that can be implemented at various levels.

– Sustainability and revenue diversification: How can educational institutions ensure long-term financial stability? We’ll discuss the importance of diversifying revenue sources and developing sustainable financial models.

By unlocking the secrets of educational finance and funding, you’ll gain a deeper understanding of the mechanisms that drive the educational system. Whether you’re a student navigating the world of scholarships or an educator seeking ways to secure funding for innovative projects, the insights shared in this blog post will empower you to make informed decisions and contribute to the improvement of the education landscape.

Remember, educational finance is a complex field that evolves over time. Stay curious, explore opportunities, and seek expert advice when needed. Together, we can unlock the full potential of education through effective finance and funding strategies.