Achieving financial stability is a critical aspect of life that can be challenging to attain. However, with the right approach and mindset, anyone can achieve it. In this guide, we will discuss some practical tips that can help you achieve financial stability and become financially independent.

1. Set Financial Goals

The first step in achieving financial stability is to set financial goals that are specific and achievable. For instance, if you want to save for retirement, you should determine how much money you need to save monthly or annually and put a plan in place to achieve this goal. Setting financial goals helps you to be responsible and focused, and this applies to both short-term and long-term financial goals.

2. Create a Budget

Creating a budget is arguably one of the most vital steps in achieving financial stability. A budget helps you make informed financial decisions by tracking your spending vs. your income. By preparing a budget, you can easily identify the areas where you are overspending and adjust accordingly. A budget can also help you plan for unexpected expenses, emergencies, or situations that can jeopardize your financial stability.

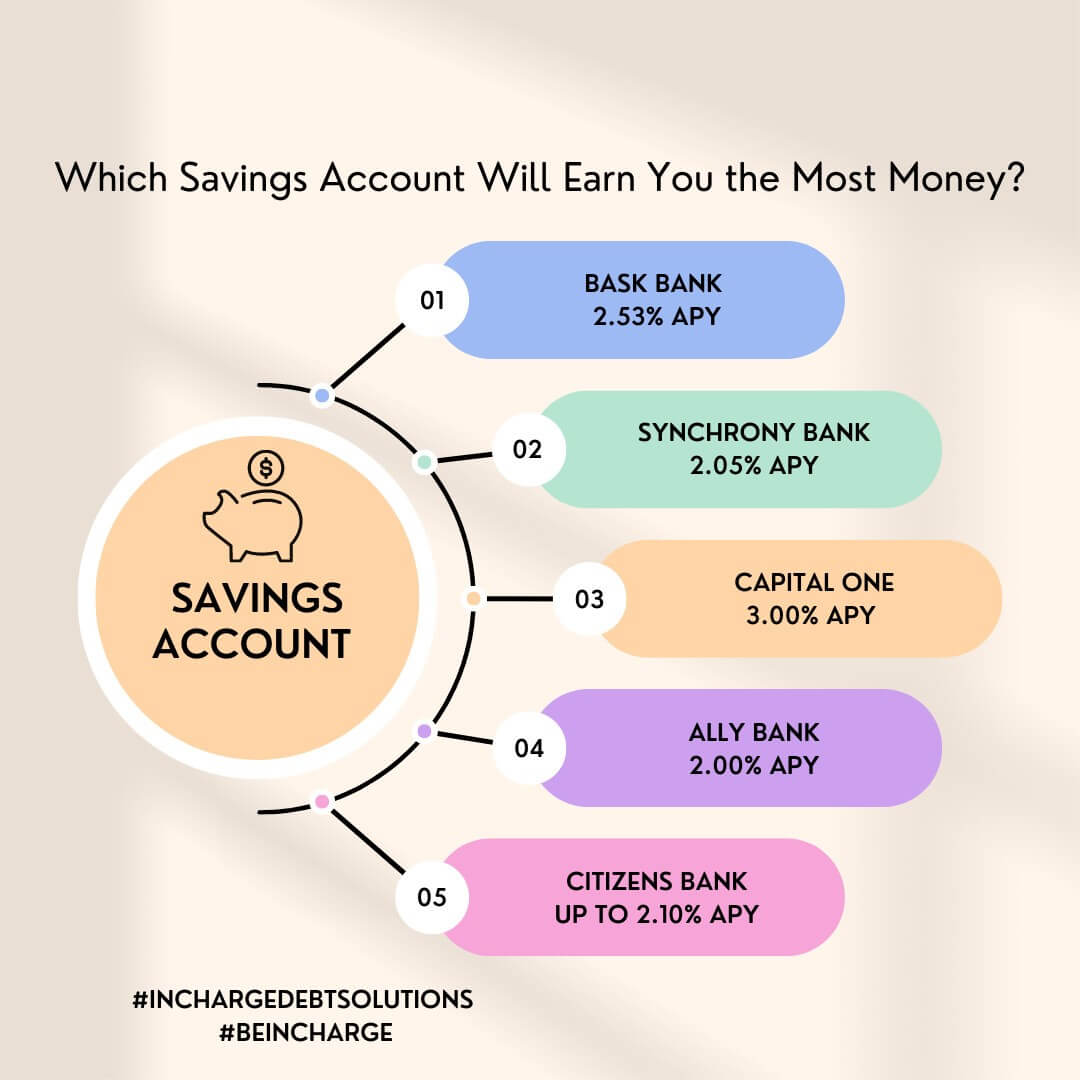

3. Build an Emergency fund

Life is unpredictable, and unexpected events can happen, such as medical emergencies, car breakdowns, or job loss. Building an emergency fund can provide you with financial cushioning to tide you through such situations. As a rule of thumb, your emergency fund should contain at least three to six months of your living expenses.

4. Reduce Debt

Debt can be a burden that can hinder your financial stability. Therefore, to achieve financial stability, it is essential to reduce or eliminate your debts. You can start by creating a debt repayment plan that works for you, whether it’s paying off high-interest debts first or focusing on debts with smaller balances. By eliminating your debts, you’ll be one step closer to achieving financial freedom.

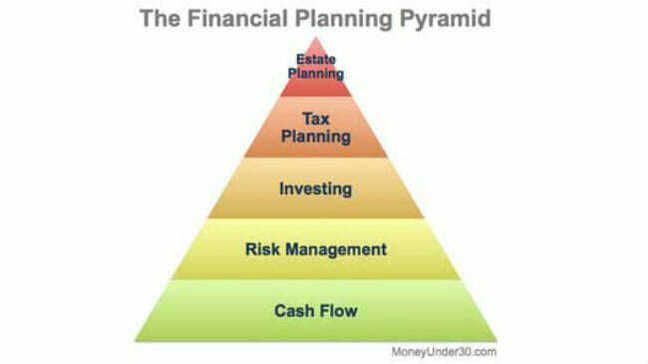

5. Invest in your Future

Investing in your future is an excellent way to achieve financial stability and independence. There are several investment options available, such as buying stocks, bonds, mutual funds, or investing in real estate. Regardless of the investment option you choose, you need to be strategic in your investment portfolio and align your investments to match your financial goals and risk tolerance.

In Conclusion

Achieving financial stability requires discipline, patience, and an unwavering commitment to your financial goals. By setting financial goals, creating a budget, building an emergency fund, reducing debt, and investing in your future, you can gain financial stability and pave the way toward financial freedom. Remember, financial stability is not an overnight accomplishment, but a journey that requires steadfast determination and consistency.