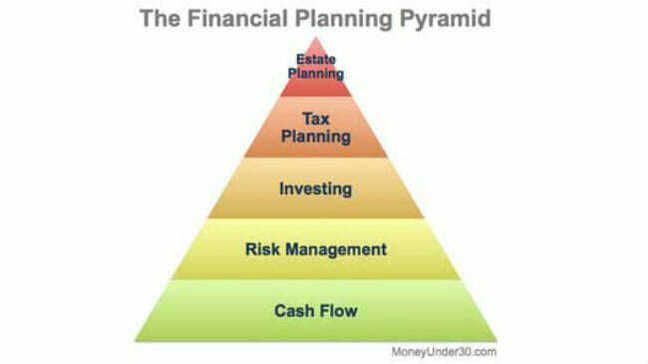

Managing finances can seem like a daunting task for many people, but it is a crucial step towards achieving financial freedom. Financial freedom means having control over your finances and living a life that is not dependent on a paycheck. In this article, we will discuss some steps that you can take to manage your finances and achieve financial freedom.

1. Create a Budget: The first step towards financial freedom is creating a budget. A budget will help you plan your expenses and income, and it will allow you to identify areas where you can cut back on spending. Start by listing all your bills and expenses, such as mortgage or rent, utilities, groceries, car payments, and so on. Identify your income and compare it to your expenses to see how much money you have left over. Then, allocate that money towards savings and investments.

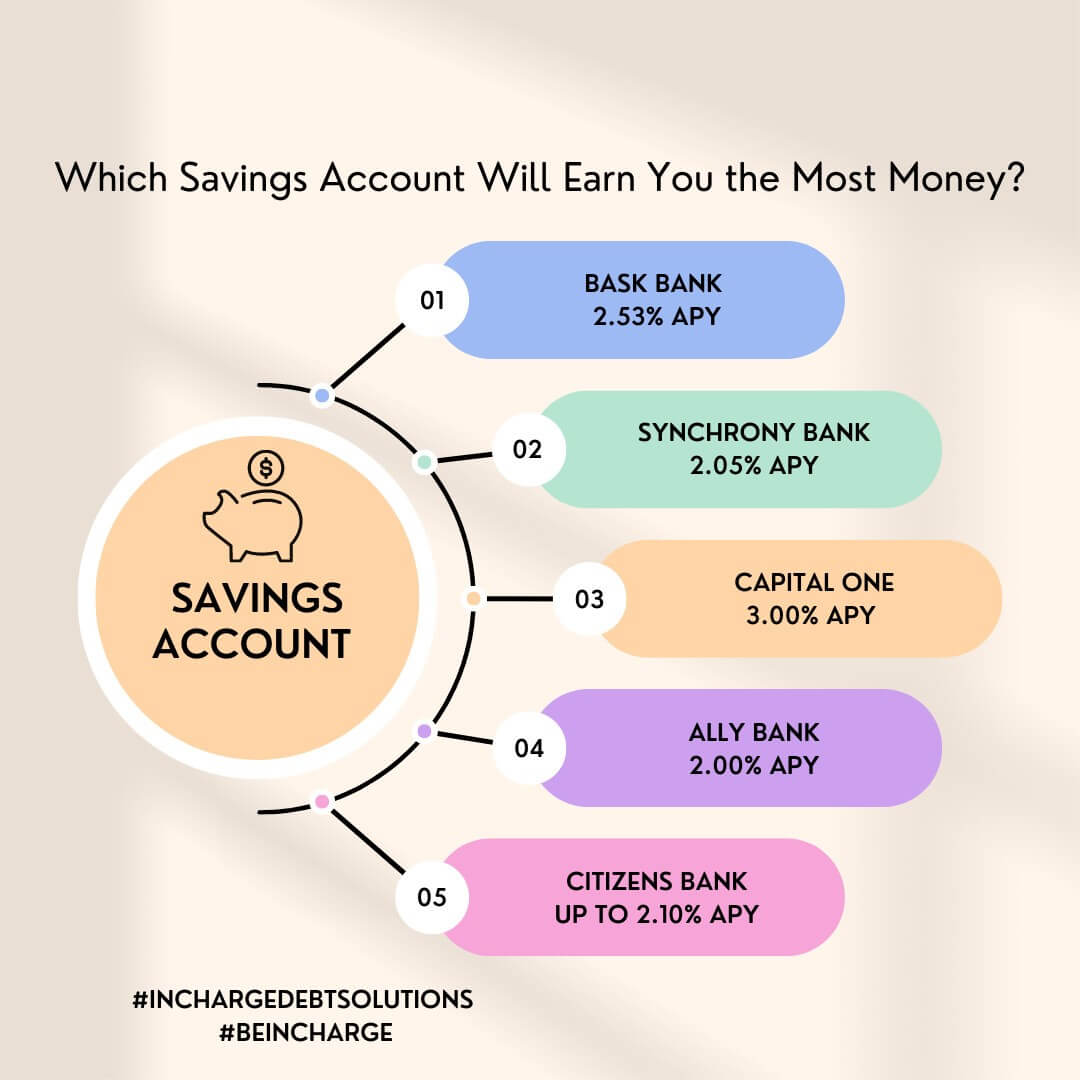

2. Save for Emergencies: Emergencies are unexpected events that can happen at any time, such as medical emergencies or job loss. Having an emergency fund will help you deal with these situations without having to dip into your savings or investments. Experts recommend having three to six months’ worth of living expenses saved up in an emergency fund.

3. Pay Off Debt: Debt can be a significant factor that holds you back from achieving financial freedom. High-interest debt, such as credit cards and loans, can be a burden on your finances. Start by paying off high-interest debt first, as it will save you money in the long run. You can also consider consolidating or refinancing your debt to lower interest rates.

4. Invest for the Future: Investing is a key factor in achieving financial freedom. Investing your money can help you grow your wealth and build a more stable financial future. There are many investment options available, such as stocks, bonds, mutual funds, and real estate. Do your research and consult a financial advisor to determine the best investment option for your financial goals.

5. Live Below Your Means: Living below your means is a crucial factor in achieving financial freedom. It means that you prioritize saving and investing over spending on unnecessary items. Avoid overspending on things that don’t add value to your life and try to find ways to reduce your expenses.

In conclusion, managing finances is an essential step towards achieving financial freedom. By creating a budget, saving for emergencies, paying off debt, investing for the future, and living below your means, you can take control of your finances and build a stable financial future. Remember that financial freedom is achievable with discipline, patience, and dedication.