Mastering Money – Tips and Tricks

Managing your finances can be a daunting task, but it doesn’t have to be. By mastering your money, you can live a stress-free life where you have financial security. Here are some tips and tricks to help you master your money.

1. Budgeting

Budgeting is one of the most important tools in mastering your finances. By creating a budget, you can ensure that you are living within your means. Start by listing all of your income and expenses. Then, prioritize your expenses and cut out any unnecessary spending.

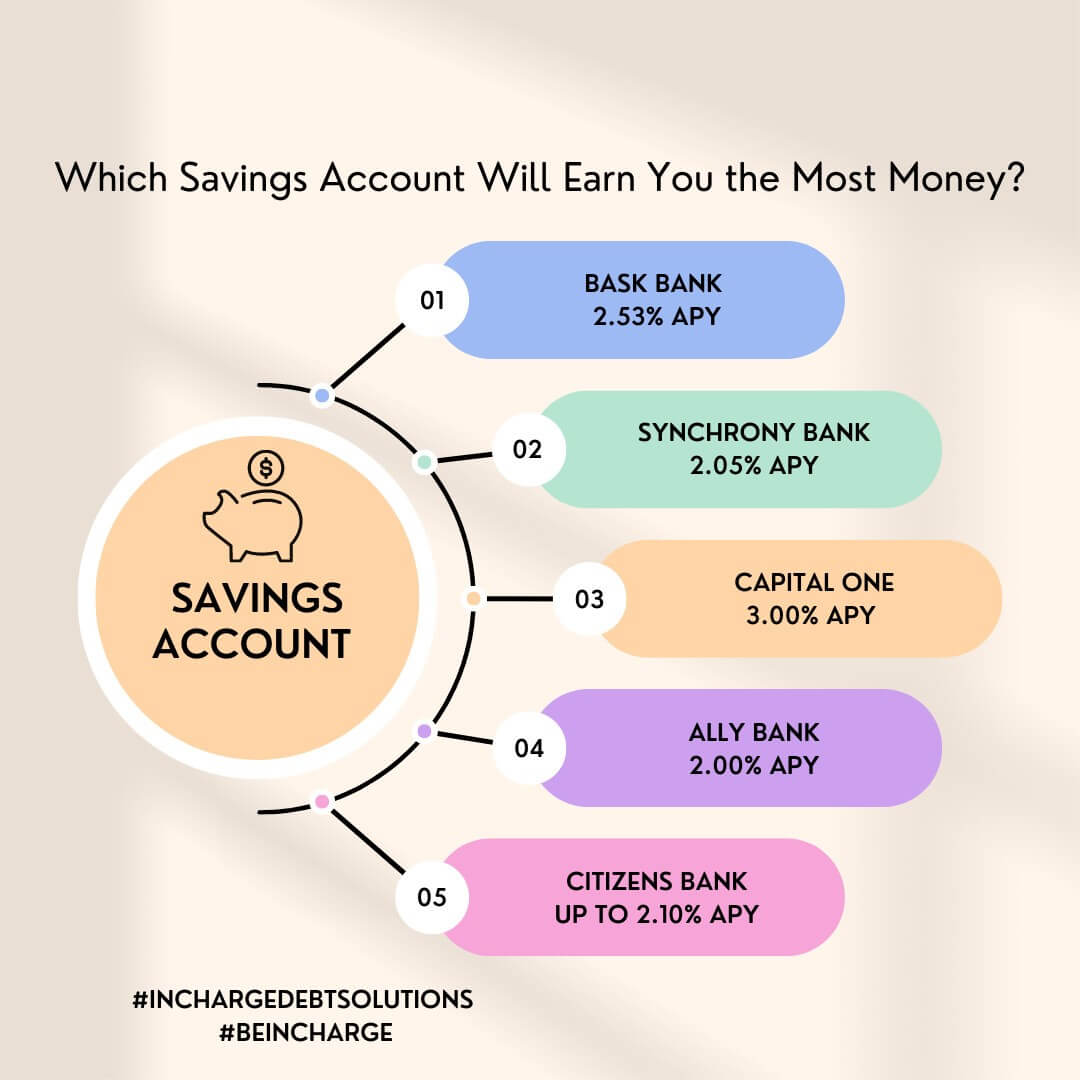

2. Saving

Saving is another crucial aspect of mastering your finances. Set a goal for how much you want to save each month and stick to it. Make saving automatic by setting up a direct deposit into a high-yield savings account. This will make it easier to save consistently.

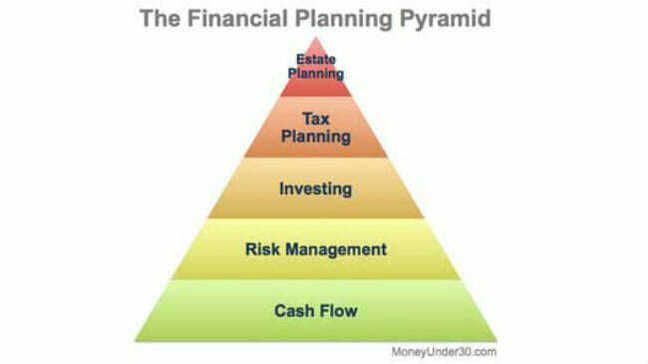

3. Investing

Investing is essential for achieving long-term financial stability. Start by understanding your risk tolerance and investing in a diversified portfolio. You can also consider working with a financial advisor to help you make informed investment decisions.

4. Cutting Expenses

Cutting expenses doesn’t mean sacrificing your quality of life. Start by examining your monthly bills and making changes where you can. This could mean downgrading your cable package or canceling memberships you don’t use. Small changes can add up to significant savings over time.

5. Avoiding Debt

Debt can be a significant hindrance to mastering your finances. Avoid taking on too much debt, especially high-interest credit card debt. If you have debt, create a plan to pay it off and avoid taking on more debt until it’s paid off.

6. Monitoring Credit Score

Your credit score is an essential factor that affects your financial stability. Stay on top of your credit score by monitoring it regularly. You can also build your credit score by making timely payments and keeping your credit utilization low.

By implementing these tips and tricks, you can master your money and achieve financial security. Remember, financial stability is a journey, and it takes time to get there. Stay consistent, patient, and committed to your financial goals, and you will eventually get there.