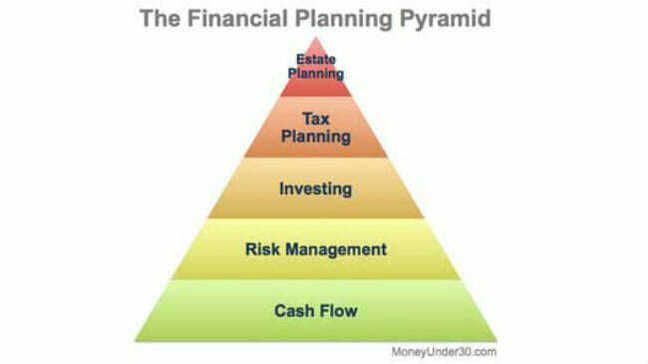

Personal finance is a critical aspect of life that touches every area of life. Being able to master your personal finance like a pro can significantly impact your financial stability and long-term financial success. Proper management of personal finance requires discipline, knowledge, and a bit of time investment. However, the good news is that anyone can master personal finance like a pro, regardless of their financial background or starting point. Here are some practical tips for mastering personal finance like a pro:

1. Create a budget

Creating a budget is the first step in mastering personal finance. A budget is a simple plan that helps you track your spending and ensure you are living within your means. Start by listing your monthly income, including your salary and other sources of income, then, put down all your monthly expenses, from rent to utilities, food, and entertainment. When you have everything listed, carefully evaluate your expenses, and identify areas where you could cut back. Creating a budget can be an eye-opener for you, showing you areas where you can save more.

2. Live within your means

Living within your means is one of the most important principles of personal finance. It is the foundation for achieving long-term financial success. Living beyond your means leads to debt and a potential financial crisis. Living within your means entails spending less than you earn, avoiding debt, and saving more. It may mean cutting back on unnecessary expenses, finding ways to increase your income, or taking a long-term approach to big purchases and investments.

3. Eliminate Debt

Debt can be a major hindrance to mastering personal finance. High-interest debt such as credit card balances can set you back and significantly hinder your financial progress. One of the best ways to eliminate debt is by paying more than the minimum monthly payments required. Additionally, you may consider consolidating your debts into a single loan with a lower interest rate.

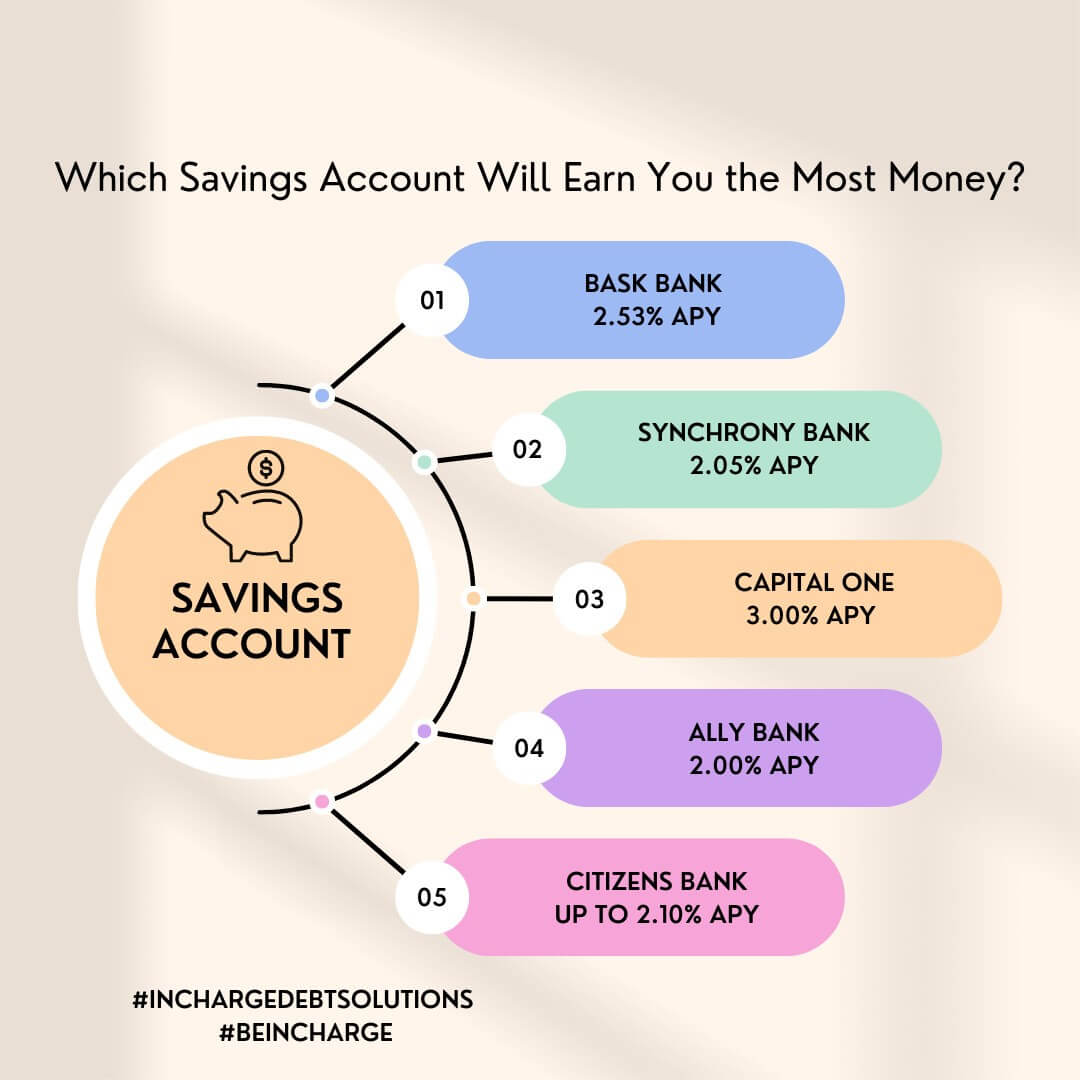

4. Save for emergencies

Saving for emergencies is a critical aspect of personal finance. Emergencies such as unexpected medical expenses or job loss can seriously affect your financial stability. Having a savings plan for these situations can reduce the negative impact of unexpected financial necessities. It is recommended that you aim to have at least six months worth of living expenses saved up in an emergency fund.

5. Plan for retirement

Retirement planning is an essential phase of mastering personal finance. It is never too early to start planning for retirement. Regardless of your current age or financial status, planning for retirement should be a priority. Consider setting up a retirement savings account, such as an individual retirement account (IRA) or a 401(k). Starting early and investing consistently, even with small amounts, can significantly increase your chances of achieving a financially secure retirement.

Wrapping up,

Mastering personal finance like a pro requires discipline, knowledge, and a bit of time investment. Creating a budget, living within your means, avoiding debt, saving for emergencies, and planning for retirement are all critical steps towards long-term financial stability and success. Take an honest look at your finances, set clear financial goals, and take action towards achieving them. With the right mindset and actions, anyone can master personal finance like a pro.