Mastering Personal Finance – Simple Steps

Personal finance is the key to a balanced and successful life. Managing money efficiently can help you save for the future, plan for emergencies, pay off debts, and achieve financial goals. But even though it sounds simple, managing finances is easier said than done. Most people struggle to keep track of their income and expenses and often end up with financial instability.

If you are looking to master your personal finances, here are some simple steps that you can follow:

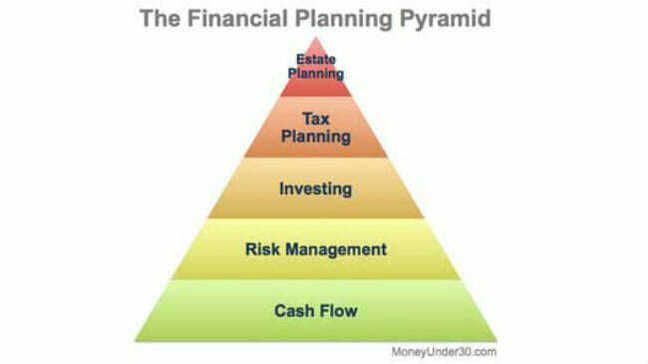

Create a budget plan – Take the time to track your expenses and create a budget plan that fits your needs and goals. Plan for monthly expenses, bills, and debt payments, but also think about long-term goals such as saving for a house or retirement.

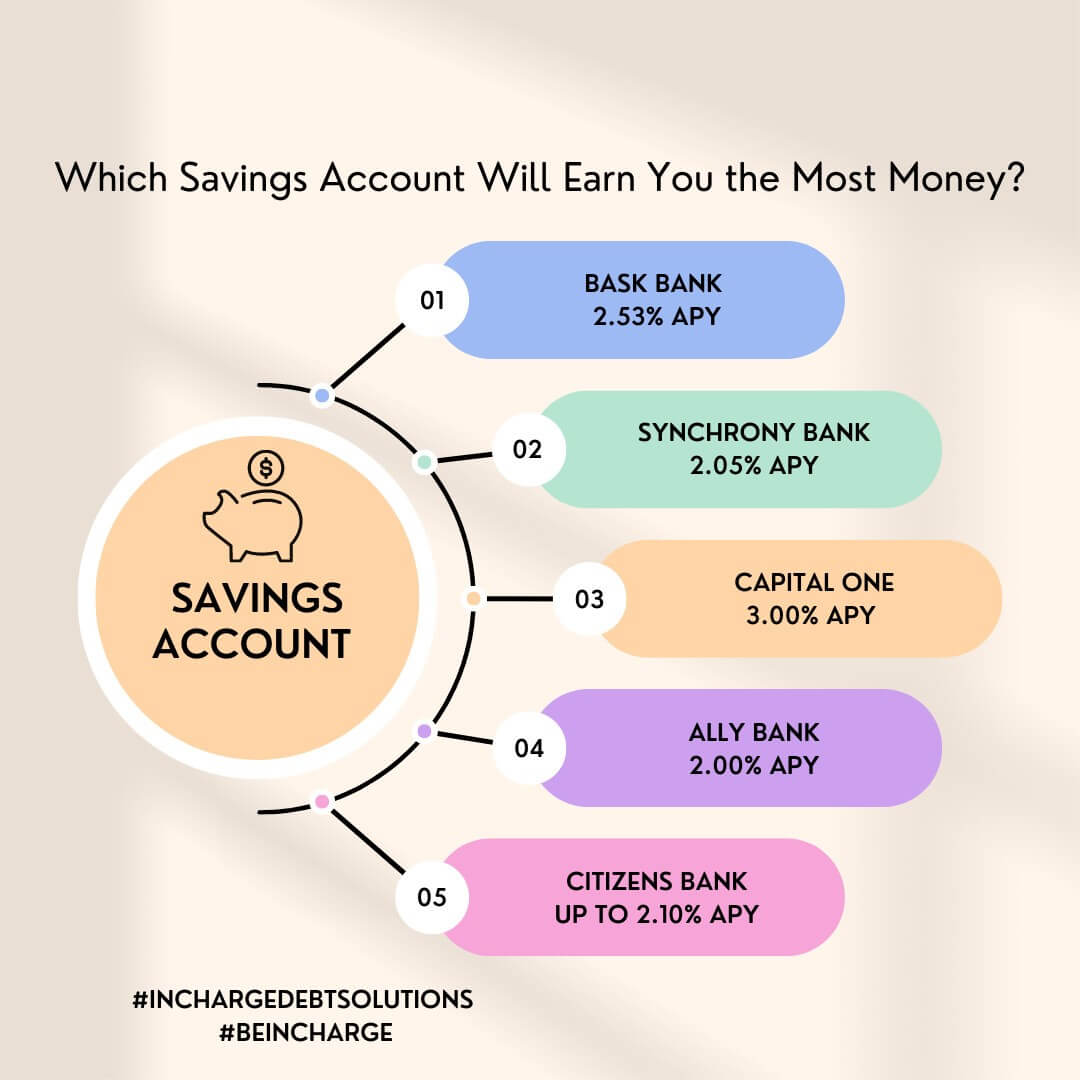

Save money – Everyone needs an emergency fund. Save a portion of your income every month or paycheque to create an emergency fund. Additionally, substantial savings could help you achieve future goals like buying a new car or going on vacation.

Pay off debts – Debts can pile up quickly, whether it is credit card debt or a loan, it can cause a great deal of stress and affect your credit score. Take some time to pay off debts before diving into making new purchases.

Invest in your future – Investing is an excellent way to grow your wealth and secure your financial future. Research different investment options and decide which one would work best for you. Ensure you always make well-informed decisions to avoid risk.

Stay on top of your bills – Late fees can quickly suck out your money. Ensure to keep track of your bills and always pay them on or before the due date.

Review your insurance – Accidents can happen at any time. Ensure to review your insurance policies and ensure you have adequate coverage.

In conclusion, mastering personal finance isn’t rocket science. With proper planning and management of finances, you could significantly improve your financial situation within a short period. However, the trick is to always stay disciplined and mindful of your finances. Remember, your future depends on your present financial habits.