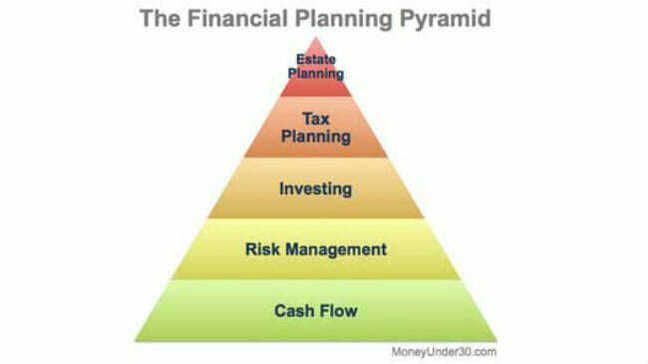

Mastering your personal finances is an essential step to achieving financial freedom and stability. It requires discipline, education, and the right mindset to take control of your finances. Here are some tips to help you become a master of your personal finances.

1. Set Financial Goals

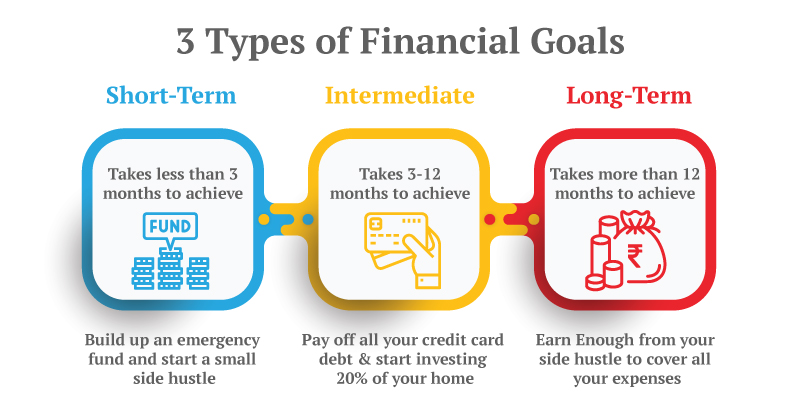

Setting financial goals is the first step to achieving financial security. Determine what you want to accomplish financially, whether it’s to save for a down payment on a house, pay off debt, or invest for the future. Establishing short-term and long-term goals is the key to staying motivated and focused on your financial objectives.

2. Create a Budget

A budget is an essential tool for controlling your finances. Start by creating a list of all your income sources and expenses. Assign a dollar amount to each category, and make sure your income exceeds your expenses. Don’t forget to include a category for unexpected expenses.

3. Live Below Your Means

Living below your means is a crucial principle of financial success. Avoid overspending on unnecessary items and focus on your basic needs. Cut expenses where possible, and think about how you can make extra money to supplement your income.

4. Save for Emergencies

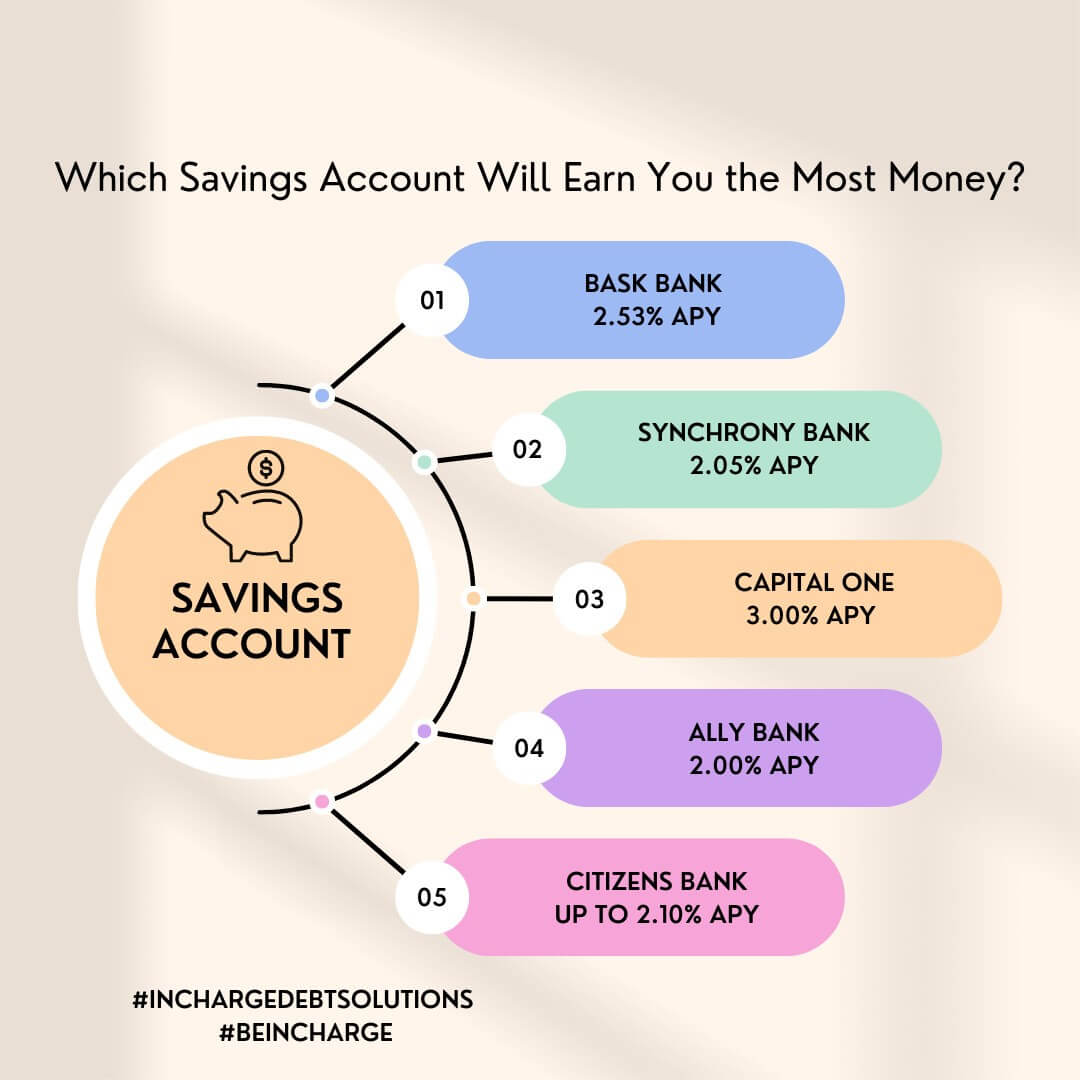

Unexpected expenses can wreak havoc on your finances. To avoid falling into debt, set aside money for emergencies. A general rule of thumb is to save three to six months of living expenses, so you have a cushion in case of job loss, car repairs, or medical bills.

5. Pay off Debt

Paying off debt should be a top priority in your financial plan. High-interest debt can be a huge financial burden, so tackle it as soon as possible. Start with the smallest debts and work your way up to the larger ones. Consider consolidating debt to lower interest rates or negotiating with creditors to reduce payments.

6. Invest for the Future

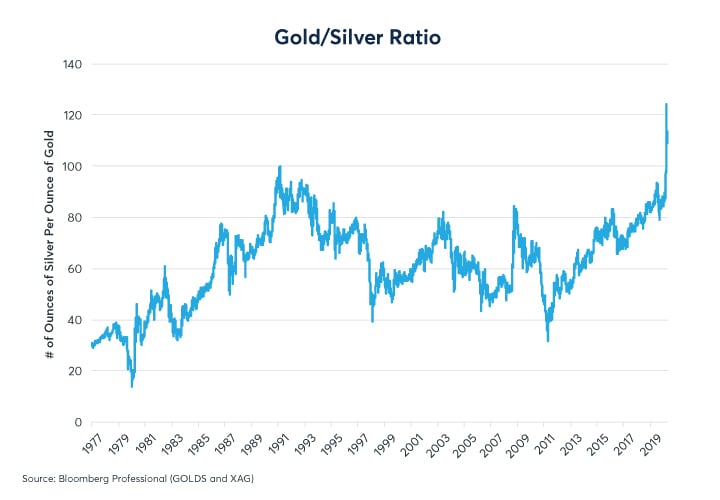

Investing for the future is essential for long-term financial security. Choose investments that align with your financial goals, risk tolerance, and time horizon. Diversify your portfolio to reduce risk, and monitor your investments regularly to ensure they are performing as expected.

In summary, mastering your personal finances involves setting goals, creating a budget, living below your means, saving for emergencies, paying off debt, and investing for the future. By following these tips, you can take control of your finances and achieve financial stability.