As a young adult, it’s important to start saving early for a secure financial future. Here are some tips on how you can start:

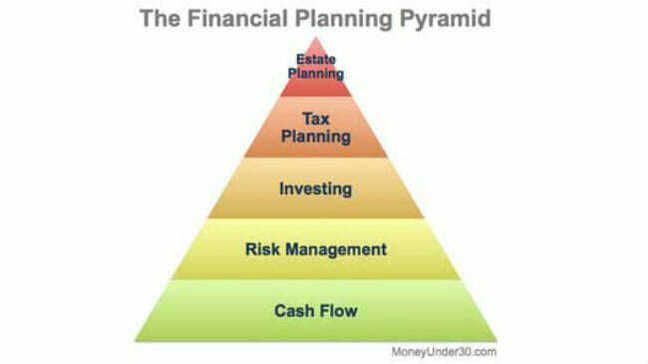

1. Set a budget: It’s essential to have a clear understanding of your income and expenses. Set up a spreadsheet or use a budgeting app to create a financial plan for your income, expenses, and savings goals.

2. Cut back on unnecessary expenses: Identify where you can cut back on non-essential expenses like dining out, shopping for clothes, or buying expensive coffee. Small expenses add up quickly, and you could save a considerable amount by avoiding them.

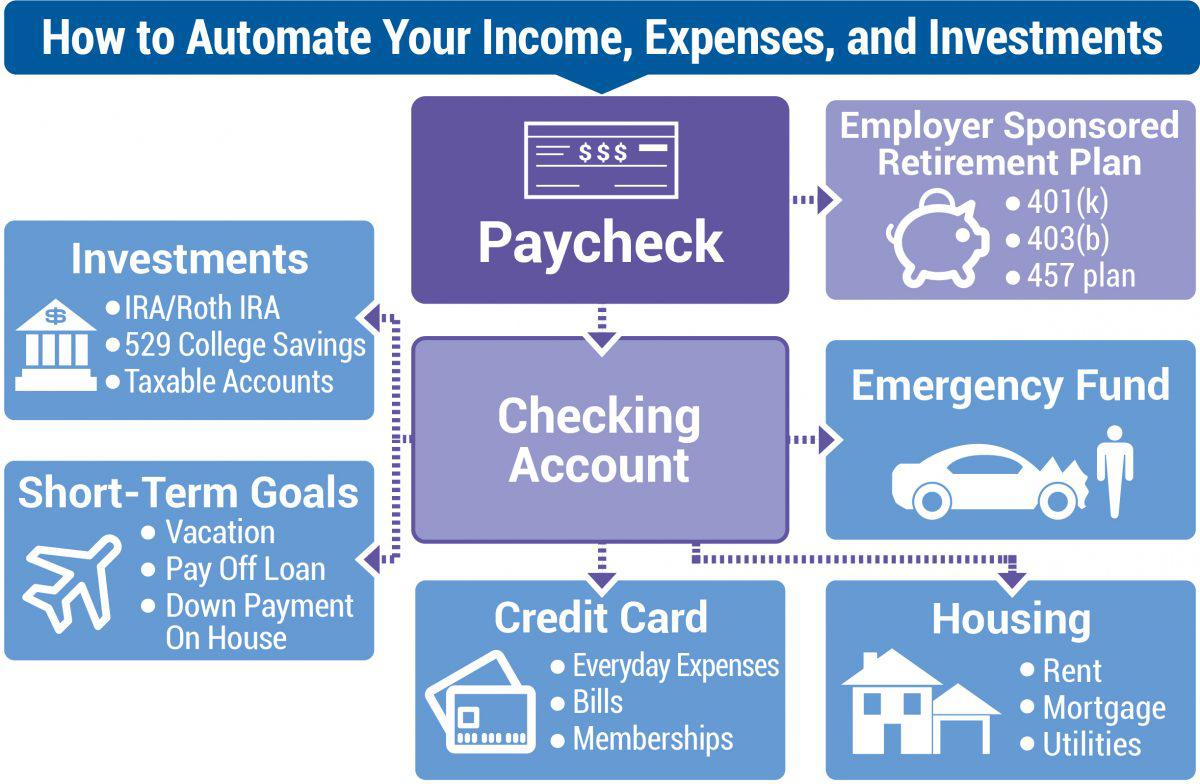

3. Automate your savings: Set up an automatic transfer of a portion of your paycheck into a savings account. This ensures that you don’t see that money and are not tempted to spend it.

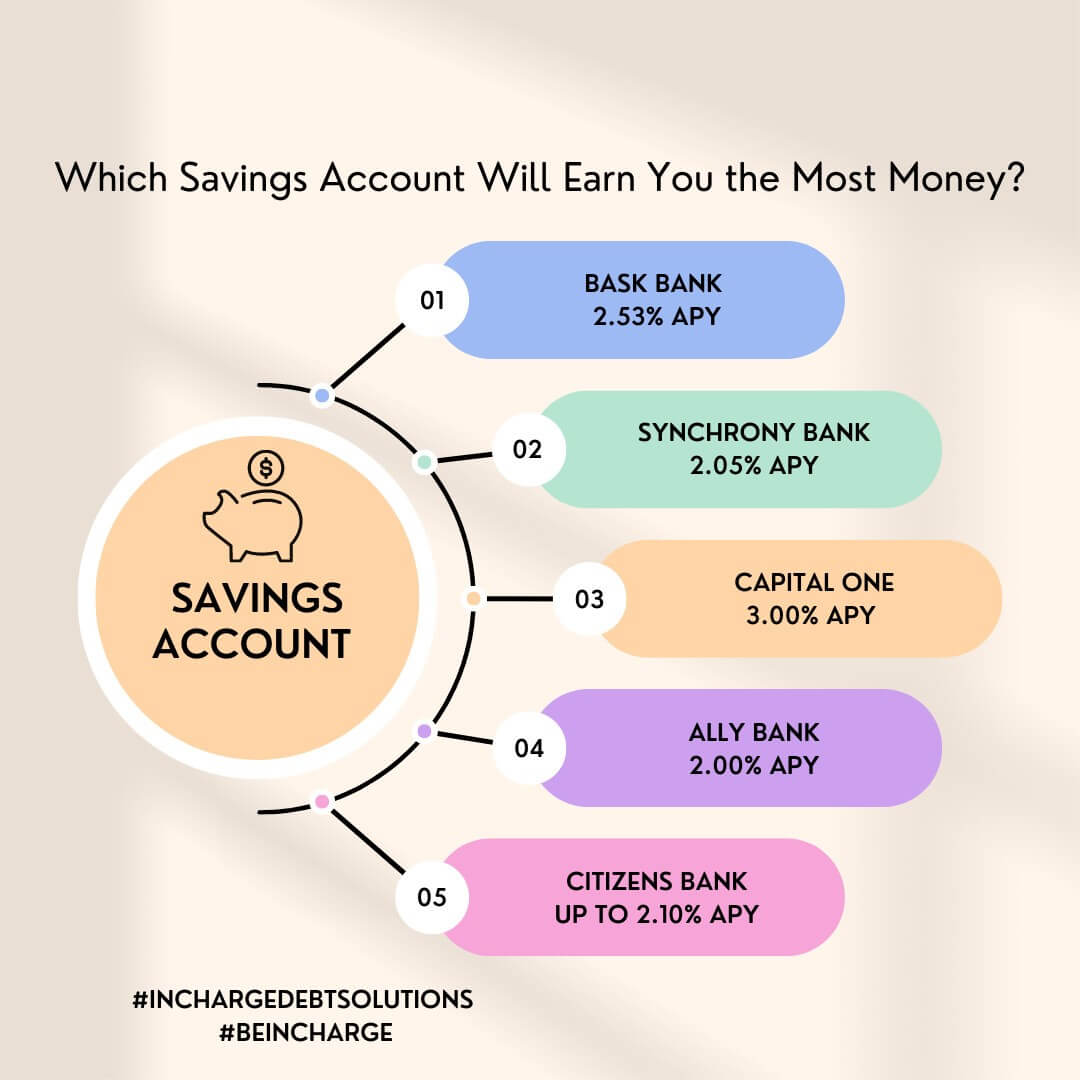

4. Use a high-yield savings account: Instead of a regular savings account, opt for a high-yield savings account that offers higher interest rates. It’s an excellent way to grow your savings without any additional effort.

5. Avoid debt: Credit card debt and loans can be costly and hurt your financial standing. Plan your expenses and save towards any future costs to avoid getting into debt.

6. Plan for retirement: The earlier you start planning, the better. Take advantage of your employer’s 401(k) plan or consider opening an IRA.

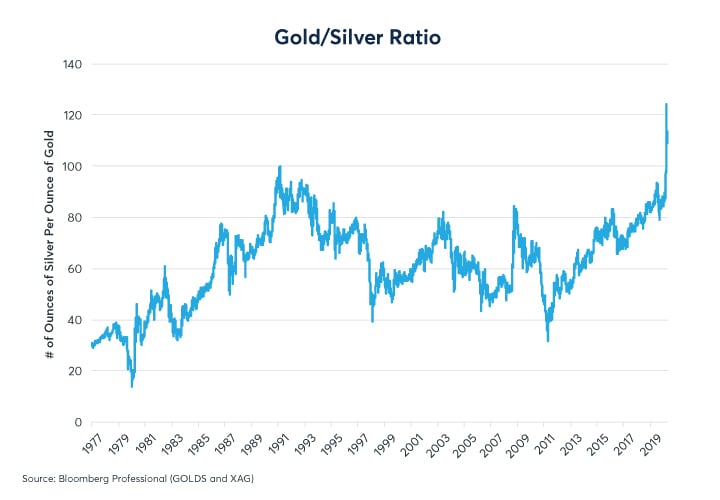

7. Invest wisely: Investing in stocks, mutual funds, or real estate can be a smart way to build wealth over the long term.

In conclusion, saving is an essential aspect of life, especially for young adults. By adopting these tips, you can start saving towards a secure financial future and ensure that you can achieve your goals without struggling financially. Remember that it’s all about forming good habits early on, so stay disciplined and stay committed.