Why the Silver to Gold Ratio Has Deviated from Historical Norms – Exploring the Impact of Money

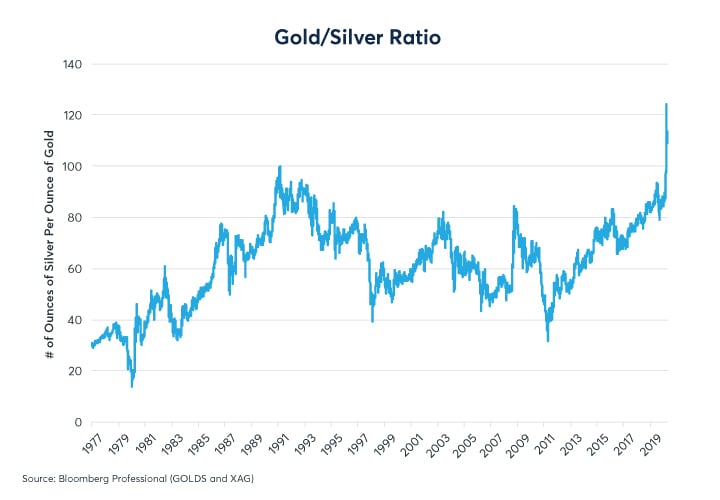

The silver to gold ratio is a crucial aspect for precious metal investors to keep an eye on. This ratio indicates the proportion of silver ounces it takes to buy an ounce of gold. Historically, the ratio has moved in certain ranges, but in recent years, it has deviated from these norms. In this blog post, we dive into the root causes of this deviation and explore the impact of money on the silver to gold ratio.

Silver and gold have been treasured assets throughout human history, thanks to their store of value and rarity. For this reason, the silver to gold ratio was relatively stable in ancient civilizations. However, modern times have seen substantial fluctuations in the ratio, with various factors contributing to these shifts.

1. The Gold Standard’s Demise

Until the 20th century, the global monetary system was mostly backed by gold, which tethered paper currencies to the precious metal. When the gold standard was dismantled during the 20th century, the prices of both gold and silver became more influenced by fiat currencies and fluctuating currency values. The end of the gold standard removed a significant connection between gold and silver, allowing the ratio to deviate.

2. Central Bank Gold Reserves

Gold holds a particular allure for central banks, which maintain vast reserves of the yellow metal. Central banks primarily use gold as a reserve asset, whereas silver is viewed more as an industrial commodity. This inherent demand for gold by these financial authorities skews the silver to gold ratio, making gold appear more valuable in this context.

3. Industrial Demand for Silver

Silver enjoys robust demand across various industrial sectors. The metal is widely used in electronics, solar panels, medical applications, and countless other industries. It is estimated that over 50% of silver’s use is for industrial purposes. Conversely, gold is predominantly used for jewelry and investment purposes. As the demand for electronics and technological advances has grown over time, the increased need for silver has contributed to fluctuations in the silver to gold ratio.

4. Inflation & Monetary Policies

Government and central bank monetary policies, including quantitative easing and interest rate manipulation, impact fiat currency values. These policies can also influence the behavior of precious metal investors, who generally seek safety in these assets amid economic uncertainty. Gold, in particular, benefits from its status as a safe-haven investment, lowering the silver to gold ratio when investors flock to gold in unstable economic conditions.

5. Sentiments & Speculation

Lastly, investor sentiment and speculative trading have a significant impact on the silver to gold ratio in the short term. Investor perspectives on the potential of the two metals can lead to price swings, which ultimately influence the ratio. For instance, short-lived speculative trends, like the “Silver Squeeze” in early 2021, caused temporary imbalances in the silver to gold ratio as investors rushed to buy silver.

In summary, the silver to gold ratio has deviated from historical norms due to the dismantling of the gold standard, central bank gold reserves, industrial demand for silver, inflation and monetary policies, and market sentiment and speculation. Understanding these factors empowers precious metal investors to make more informed decisions and capitalize on opportunities presented by the evolving relationship between silver and gold.