Creating financial security and long-term wealth is a goal that many individuals strive to achieve. With proper planning and disciplined strategies, it is possible to build a strong financial foundation and secure your future. In this blog post, we will discuss five proven strategies that can help you achieve financial security and long-term wealth.

1. Develop a Budget: The first step in creating financial security is to develop a budget. A budget allows you to track your income and expenses, enabling you to allocate your funds wisely. By categorizing your expenses and prioritizing your financial goals, you can optimize your spending and save more money for the future.

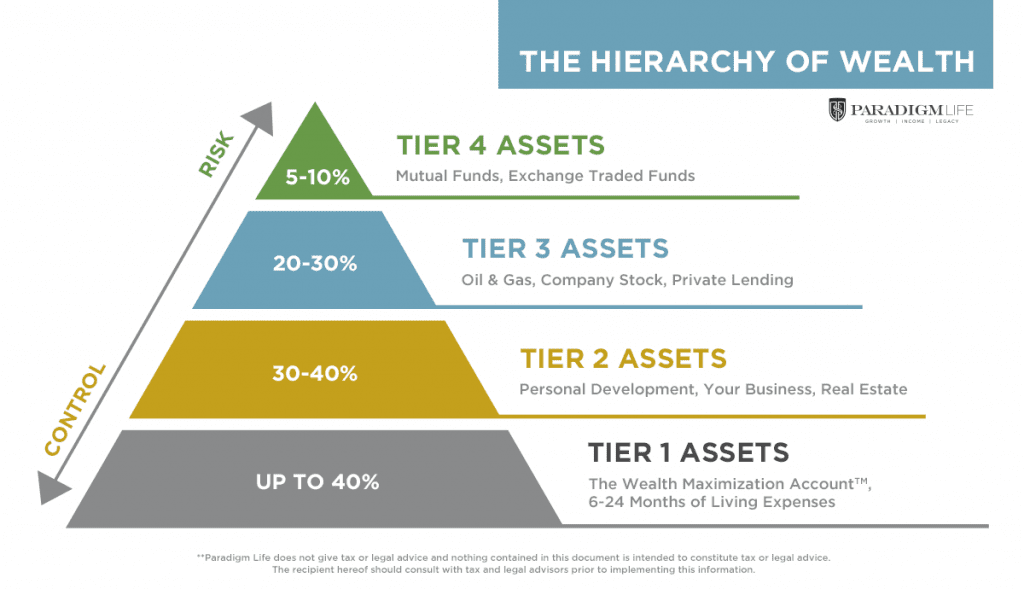

2. Save and Invest: Saving money is essential for creating financial security. Start by creating an emergency fund that covers at least three to six months of living expenses. Once you have established an emergency fund, focus on long-term investments. Consider diversifying your portfolio by investing in stocks, bonds, real estate, or mutual funds. Prioritize sound investment strategies, such as dollar-cost averaging and regular portfolio rebalancing, to maximize your returns and mitigate risks.

3. Pay Off Debt: Debt can be a significant obstacle to financial security. Prioritize paying off high-interest debts, such as credit card debt, as quickly as possible to reduce interest charges and improve your credit score. Create a debt repayment plan and allocate a portion of your budget towards debt repayment each month. Once you have paid off your high-interest debts, focus on eliminating any other outstanding debts you may have.

4. Plan for Retirement: Retirement planning is crucial for long-term wealth creation. Start by contributing to a retirement account, such as a 401(k) or IRA. Take advantage of any employer matching contributions to maximize your savings. Consider consulting with a financial advisor to determine the right contribution amount and investment strategy for your retirement goals.

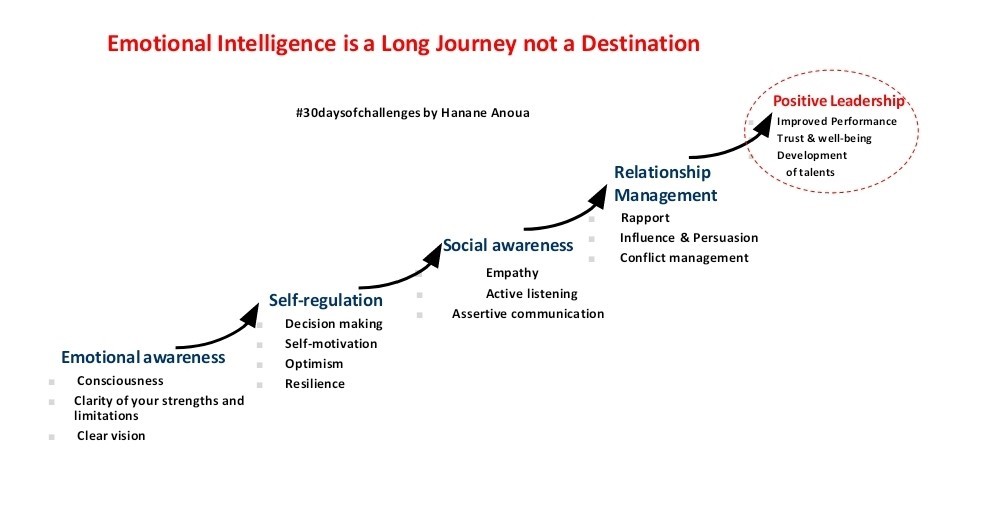

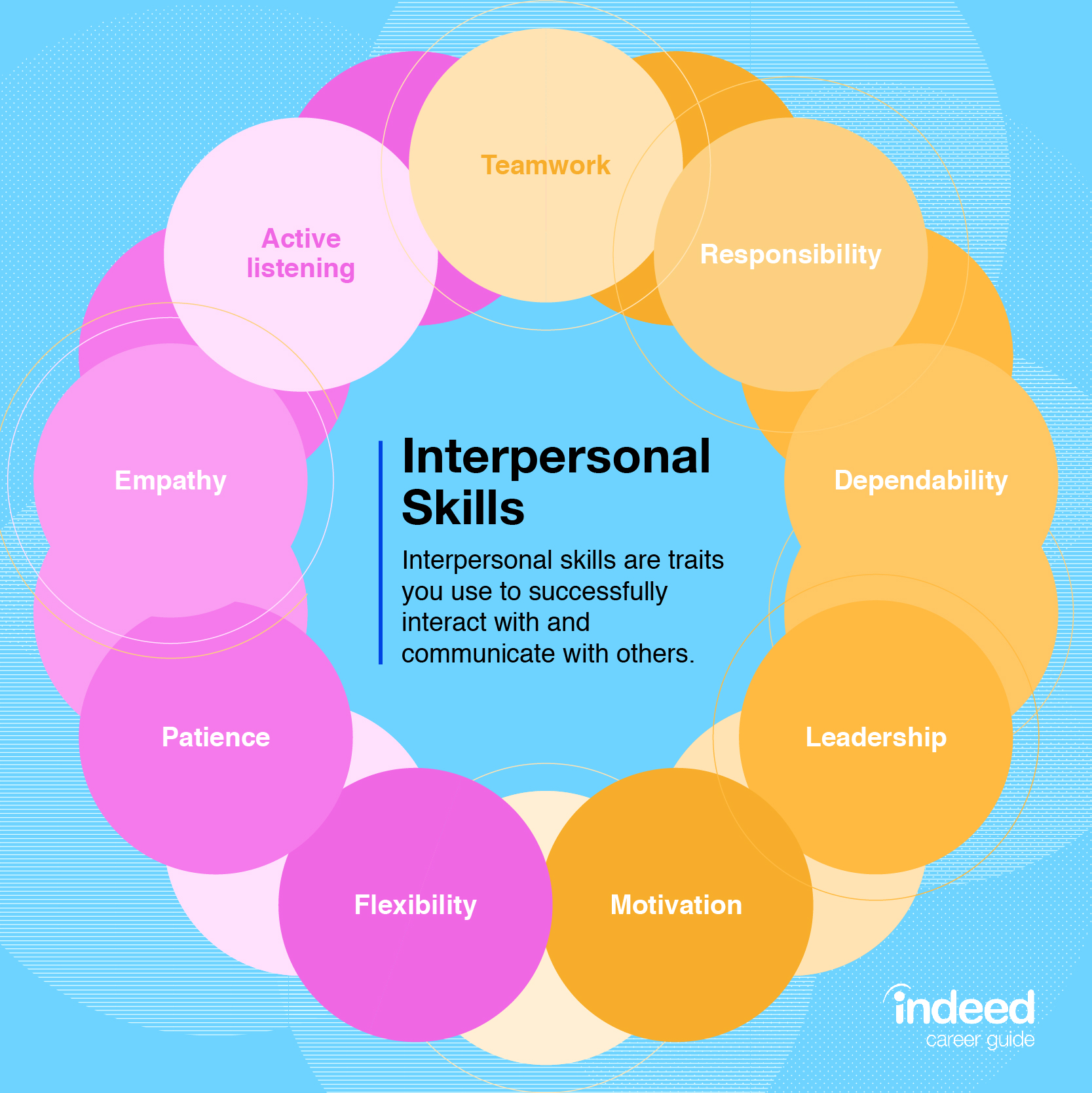

5. Increase Your Income: Creating financial security also involves increasing your income. Look for opportunities to advance in your career, acquire new skills, or start a side hustle. Develop a growth mindset that embraces continuous learning and self-improvement. By increasing your earning potential, you can save more, invest more, and accelerate your journey towards financial security.

In conclusion, creating financial security and long-term wealth requires a combination of disciplined strategies and wise financial management. Develop a budget, save and invest wisely, pay off debt, plan for retirement, and increase your income to build a strong financial foundation. By implementing these proven strategies, you can pave the way to a financially secure future. Start taking action today and reap the rewards in the long run.