Title: Creating Long-Term Financial Stability – A Guide to Wealth Building and Personal Development

Introduction:

In today’s fast-paced world, achieving long-term financial stability is a common aspiration for many individuals. However, building wealth requires a comprehensive approach that includes both financial strategies and personal development. This blog post aims to provide a practical guide to help you navigate the path towards financial stability, integrating valuable insights from the worlds of wealth building and personal growth. Get ready to embark on a transformative journey and take control of your financial future!

Keyword: Long-term financial stability

Section 1: Setting the Foundation for Success

1.1 Defining Your Financial Goals: Begin by clearly defining your short and long-term financial goals. Make them specific, measurable, achievable, relevant, and time-bound (SMART). This clarity will provide you with direction and motivation on your wealth-building journey.

1.2 Crafting a Budget: Establish a budget based on your income, expenses, and savings goals. Track your spending, identify areas for improvement, and allocate funds wisely. Consider using budgeting apps or tools to streamline this process and accurately monitor your financial progress.

Keyword: Wealth building strategies

Section 2: Implementing Wealth Building Strategies

2.1 Building an Emergency Fund: Start by setting aside a portion of your income as an emergency fund to cover unexpected expenses. Aim for at least three to six months’ worth of living expenses, ensuring a safety net in uncertain times.

2.2 Paying off Debts: Prioritize paying off high-interest debts, such as credit cards or personal loans. Use the avalanche or snowball method, whichever suits you best, to reduce your debt burden systematically. Remember to make timely payments and avoid incurring unnecessary interest charges.

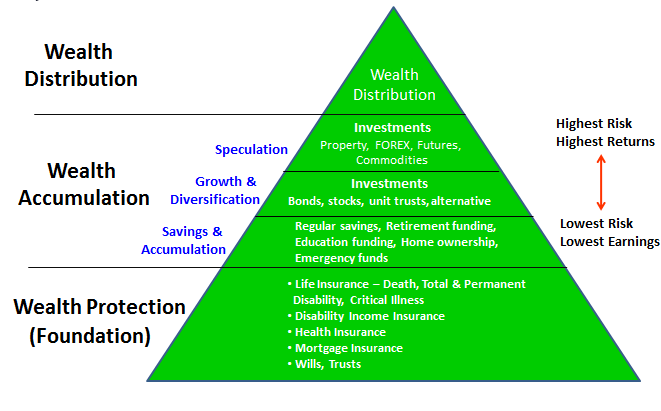

2.3 Investing for the Future: Diversify your investment portfolio to maximize wealth creation. Consider various investment options, such as stocks, bonds, mutual funds, real estate, and retirement accounts. Educate yourself about investment principles and explore low-cost index funds or robo-advisors for effective long-term growth.

Keyword: Personal development for financial stability

Section 3: Personal Development for Financial Stability

3.1 Continuous Learning: Invest in your knowledge and enhance your financial literacy. Read books, attend seminars, or follow reputable financial experts to stay updated on personal finance topics. By expanding your knowledge, you’ll be equipped to make informed financial decisions.

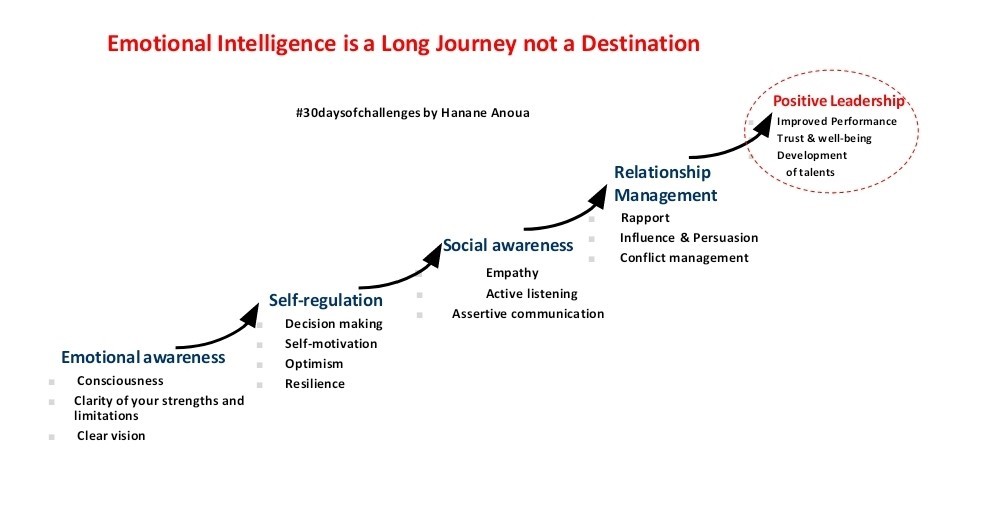

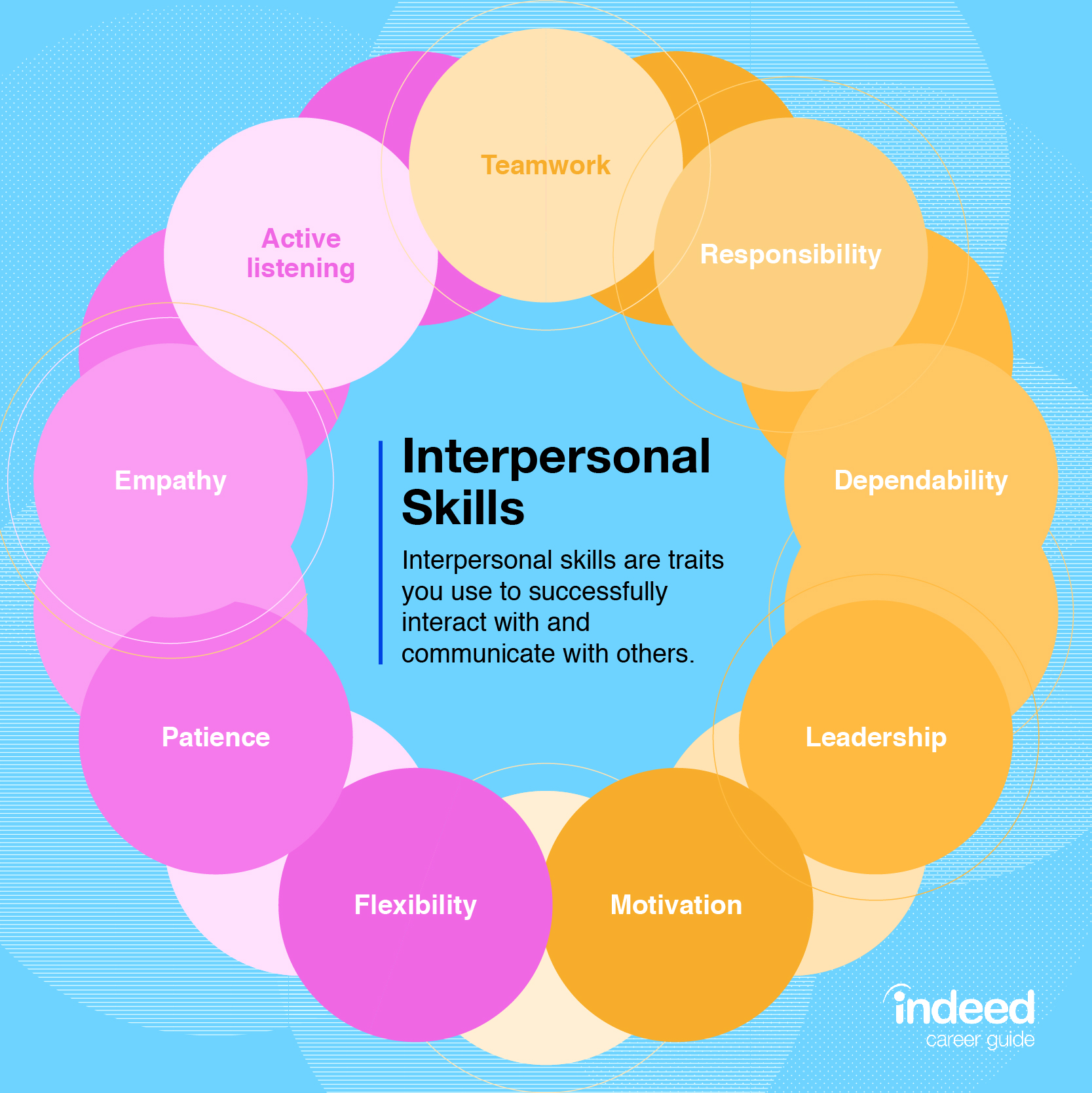

3.2 Developing Critical Skills: Identify and develop skills that can enhance your earning potential. Consider acquiring new certifications or gaining expertise in areas aligned with your long-term goals. Improving your skills can help you secure better job opportunities or grow your own business.

3.3 Enhancing Financial Mindset: Cultivate a positive mindset towards money and wealth. Challenge limiting beliefs and adopt an abundance mindset. Practice gratitude, visualization, and affirmations to reinforce a healthy financial mindset that attracts prosperity.

Keyword: Long-term financial stability with personal growth

Conclusion:

Creating long-term financial stability requires a holistic approach that incorporates both wealth-building strategies and personal development. By setting clear goals, adopting smart budgeting habits, implementing wealth-building techniques, and investing in personal growth, you can pave the way towards a secure financial future. Remember, this journey is not just about accumulating wealth but also about discovering your full potential and living a fulfilling life. Embrace the tips shared in this guide and take proactive steps to achieve lasting financial stability. Your future self will thank you!

Remember, SEO optimization involves integrating relevant keywords naturally throughout the content and making sure the content offers value to readers.