Title: 5 Strategies to Master Budgeting and Take Control of Your Personal Finances

Introduction:

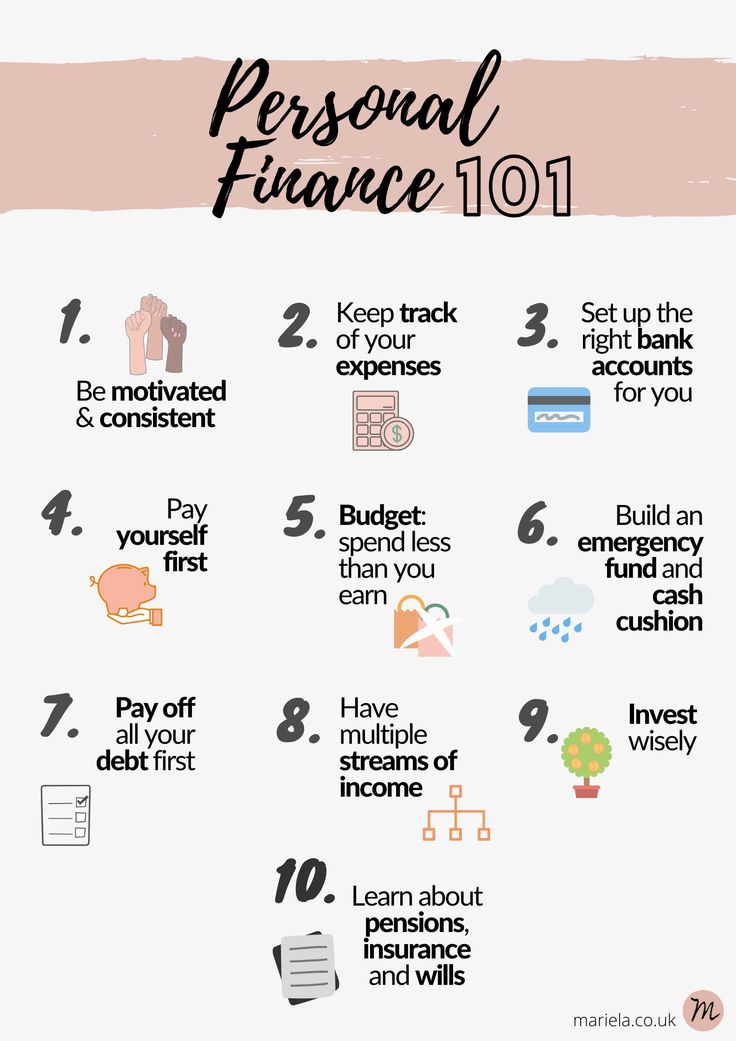

In today’s society, managing personal finances can be a daunting task. With numerous bills to pay, expenses to cover, and a limited income, it’s easy to feel overwhelmed. However, with the right strategies, you can master budgeting and take control of your personal finances. In this blog post, we will explore five helpful strategies that can help you achieve financial stability.

1. Track your expenses:

To master budgeting, you must know where your money is going. Tracking your expenses can help you identify areas where you can cut back. Several apps and software tools can assist you in keeping track of your expenses. Also, consider setting up a budgeting plan and categorizing your expenses to give you an accurate picture of your spending habits.

2. Create a realistic budget:

After identifying your spending habits, the next step is to create a budget. A budget is a financial plan that helps you control your spending habits and achieve your financial goals. When creating a budget, be realistic about your income, expenses, and monthly bills. Ensure that you allocate funds to various expenses categories such as rent/mortgage, food, transportation, and utilities.

3. Reduce your debt:

High-interest debt can take a significant toll on your finances. Consider prioritizing debts with high-interest rates, such as credit card debts. Consider negotiating with creditors or consolidating your debts to reduce your monthly payments and interest rates.

4. Increase your income:

Increasing your income is a sure way to achieve financial stability. Identify ways to increase your income, such as starting a side hustle or finding a higher-paying job. Negotiate for better pay or, if self-employed, raise your prices.

5. Save for emergencies and long-term goals:

Emergencies can occur at any time, and having an emergency fund can help you stay financially stable during such times. Also, setting long-term financial goals, such as saving for retirement or a down payment on a house, can help you plan and prioritize your expenses.

Conclusion:

Mastering budgeting requires discipline, patience, and consistency. By following these five strategies, you can take control of your finances and achieve financial stability. Remember to track your expenses, create a realistic budget, reduce your debt, increase your income, and save for emergencies and long-term goals. With time and determination, you can master budgeting and take control of your personal finances.