7 Simple Strategies for Growing Your Savings Fast

Introduction:

Are you looking to boost your savings quickly? Building a solid financial cushion is an essential step towards achieving your long-term financial goals. Whether you want to save for a down payment on a house, plan for retirement, or create an emergency fund, having effective strategies in place can make a significant difference. In this blog post, we will explore seven simple yet powerful strategies that can help you grow your savings rapidly. Implementing these tactics will not only bring you closer to your financial goals but also provide you with greater peace of mind.

1. Track and Analyze Your Expenses:

Before you can start saving, it’s crucial to have a clear understanding of where your money is going. Begin by tracking all your expenses for a month to identify spending patterns and areas where you can cut back. Utilize budgeting apps like Mint or Personal Capital to simplify this process. Analyze your spending habits and determine which expenses are necessary and which can be reduced or eliminated entirely.

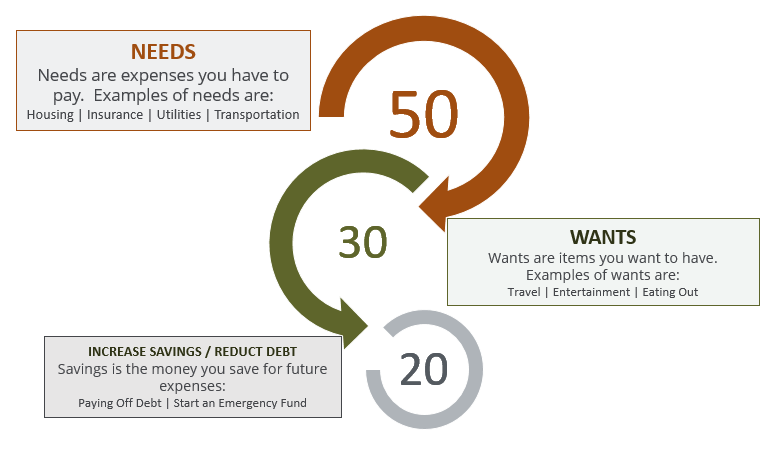

2. Create a Realistic Budget:

Once you have a clear picture of your expenses, it’s time to create a realistic budget. Allocate a specific portion of your income towards savings. Categorize your expenses into fixed (e.g., rent, utilities, loan payments) and variable (e.g., groceries, entertainment, dining out). Look for areas where you can make adjustments, such as reducing discretionary spending or renegotiating bills, to free up additional funds for savings.

3. Automate Savings:

Make saving a habit by automating the process. Set up automatic transfers from your checking account to a designated savings account on a monthly or bi-weekly basis. By doing so, you’ll remove the temptation to spend the money and ensure that a portion of your income is consistently set aside, helping your savings grow steadily over time.

4. Cut Back on Unnecessary Expenses:

Identify discretionary expenses that you can reduce or eliminate to increase your savings rate. Consider bringing lunch from home instead of eating out, canceling unused subscriptions, or downgrading to a more affordable phone plan. Small changes in your spending habits can add up significantly over time and accelerate your savings growth.

5. Increase Your Income:

While reducing expenses is crucial, boosting your income can expedite your savings even further. Look for opportunities to increase your earning potential, such as taking on a side gig, freelancing, or obtaining a certification or degree to advance your career. Consider leveraging online platforms to monetize your skills or exploring the gig economy for part-time opportunities.

6. Find Ways to Save on Major Expenses:

Major expenses like housing, transportation, and insurance can eat into your savings if left unchecked. Explore ways to reduce these costs, such as downsizing your home, refinancing your mortgage, carpooling or using public transportation, and shopping around for better insurance rates. These changes may require some initial effort, but the long-term savings can be substantial.

7. Prioritize Debt Repayment:

High-interest debt can impede your savings goals. Prioritize paying off debts like credit cards or personal loans with the highest interest rates. By reducing or eliminating these debts, you’ll free up more funds to redirect towards savings, allowing your money to grow at a faster rate.

Conclusion:

Growing your savings fast requires discipline, commitment, and a strategic approach. By implementing these seven simple strategies—tracking and analyzing expenses, creating a realistic budget, automating savings, cutting back on unnecessary expenses, increasing income, finding ways to save on major expenses, and prioritizing debt repayment—you’ll be well on your way to achieving your financial goals. Remember, every small step you take towards saving counts, and the sooner you start, the more significant the impact will be. Stay focused, stay consistent, and watch your savings grow steadily over time.