Title: Maximizing Credit Cards and Loans for Personal Financial Success

Meta Description: Learn how to make the most of your credit cards and loans to achieve personal financial success. This blog post provides valuable tips and strategies for optimizing your financial decisions. Discover how to manage debt responsibly, improve your credit score, and make informed borrowing choices.

Introduction:

In today’s world, credit cards and loans play a significant role in our financial lives. When used wisely, these financial tools can help us achieve personal financial success. But how can we make the most of them? In this blog post, we’ll explore effective strategies for maximizing credit cards and loans while ensuring responsible debt management. Whether you’re looking to improve your credit score, save money on interest, or make informed borrowing decisions, these tips will help you on your path to financial success.

1. Understand the Basics:

Before diving into credit cards and loans, it’s crucial to understand the basics. Familiarize yourself with key concepts such as interest rates, credit scores, and repayment terms. This knowledge will empower you to make informed decisions and avoid potential pitfalls.

2. Build and Maintain a Good Credit Score:

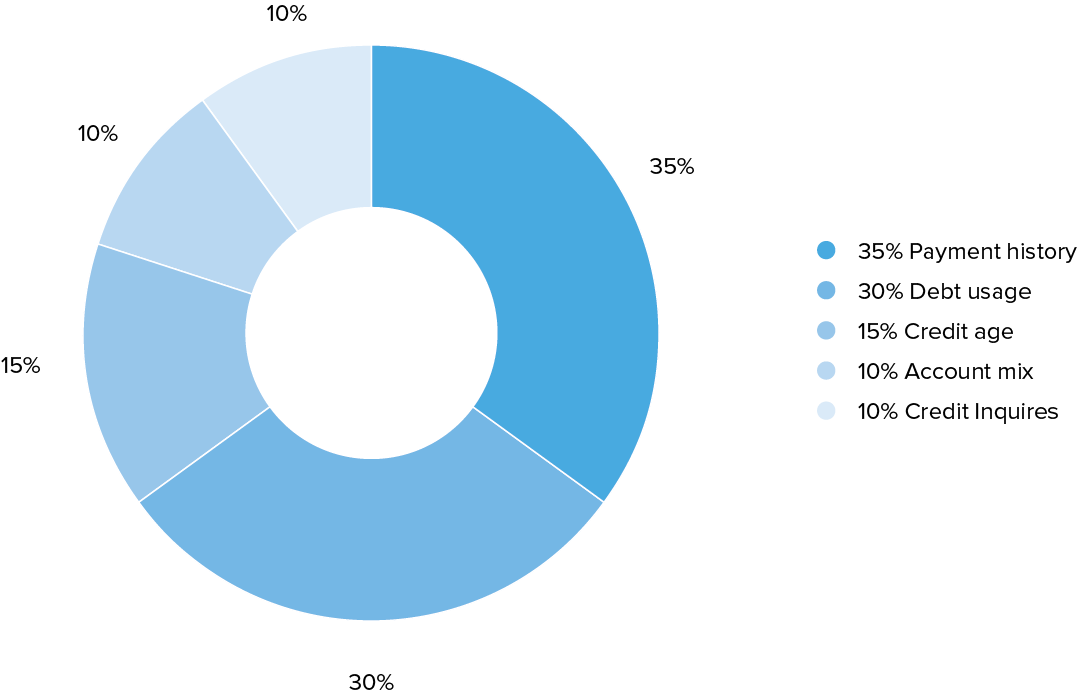

A good credit score opens the door to better borrowing opportunities. To build and maintain a strong credit score, pay your bills on time, keep your credit utilization low, and regularly review your credit reports for errors. Consider using credit monitoring services or free tools like credit score simulators to track and improve your score.

3. Select the Right Credit Cards:

With countless credit card options available, it’s essential to choose carefully. Look for cards with low annual fees, rewards programs that align with your spending habits, and competitive interest rates. Additionally, consider balance transfer cards if you have existing high-interest debt and aim to consolidate and pay off your balances more efficiently.

4. Evaluate Loan Options:

When it comes to loans, it pays to compare different lenders and loan products before settling on one. Research interest rates, repayment terms, and any associated fees. Consider whether a fixed or variable interest rate suits your needs best. Remember that personal loans can be used for various purposes, including consolidating debt, home improvements, or higher education.

5. Create a Budget and Stick to It:

To maximize the benefits of credit cards and loans, it’s crucial to manage your finances effectively. Create a budget that outlines your income, expenses, and savings goals. Use budgeting apps or spreadsheets to monitor your spending and ensure you stay within your means. Regularly evaluate and adjust your budget to align with your financial goals.

6. Pay Off High-Interest Debt:

High-interest debt can be a significant financial burden. Make it a priority to pay off loans or credit cards with the highest interest rates first. Consider debt consolidation strategies, such as transferring balances to low-interest credit cards or exploring personal loan refinancing options. Making extra payments whenever possible can accelerate your debt repayment journey.

7. Take Advantage of Rewards and Benefits:

Credit card rewards programs can provide significant value if used strategically. Maximize your rewards by understanding the card’s rewards structure and aligning your spending accordingly. Whether it’s cashback, travel points, or other perks, take full advantage of the benefits offered by your credit cards.

Conclusion:

Maximizing credit cards and loans for personal financial success requires careful planning, responsible debt management, and informed decision-making. By understanding the basics, building good credit, selecting the right credit cards and loans, and maintaining a budget, you can make the most of these financial tools. Use the tips provided in this blog post to improve your credit score, save money on interest, and achieve your financial goals. Remember, financial success lies in your hands, and by employing these strategies, you’re well on your way to a brighter financial future.