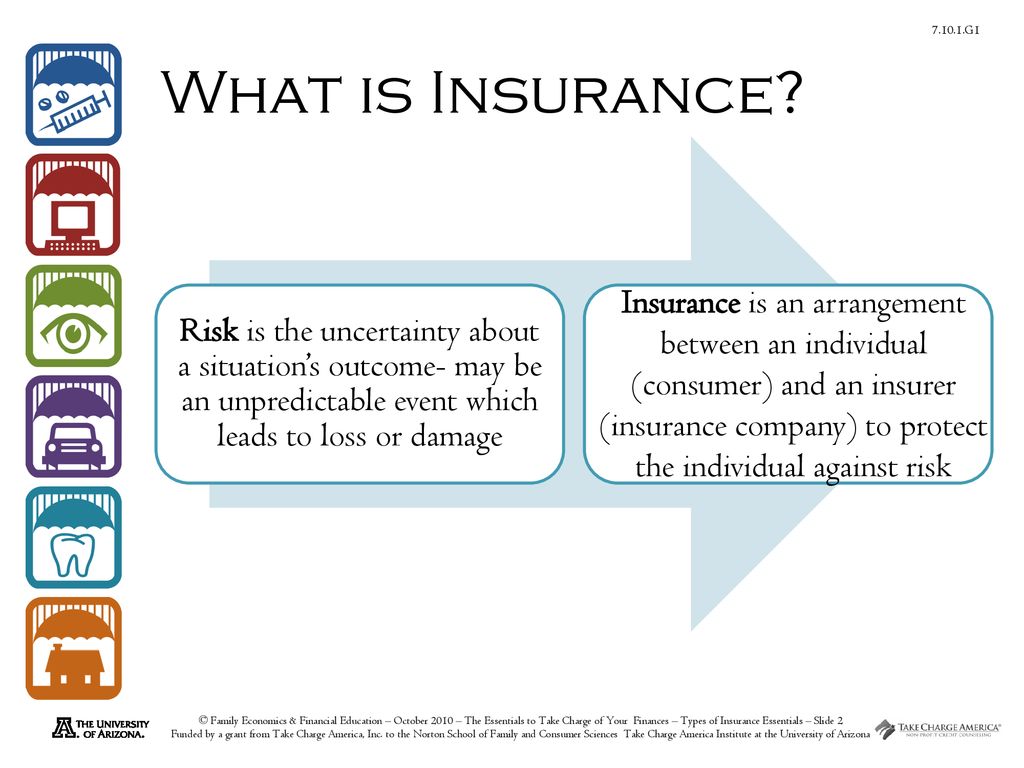

Insurance is a crucial aspect of our lives that often goes unnoticed until we need it the most. Whether it’s protecting our homes, cars, or health, insurance provides a safety net that can help us overcome unexpected financial setbacks. However, the world of insurance can be complex and overwhelming, leaving many people unsure of where to start or what to look for. In this blog post, we will cover the essentials of insurance and provide you with the knowledge you need to make informed decisions.

1. Understand the Types of Insurance:

There are various types of insurance policies available to cater to different needs. Some common types include:

– Auto Insurance: Protects your vehicles against accidents, theft, and damage.

– Homeowner’s Insurance: Provides coverage for your home and belongings against damages and liabilities.

– Health Insurance: Helps cover medical expenses and ensures access to healthcare services.

– Life Insurance: Offers financial protection to your loved ones in the event of your death.

– Disability Insurance: Provides income replacement if you are unable to work due to a disability.

– Liability Insurance: Protects you from legal responsibilities and financial losses in case of accidents or injuries caused by you or your property.

2. Assess Your Insurance Needs:

Before purchasing insurance, assess your needs based on your circumstances. Consider factors like your age, lifestyle, assets, and financial responsibilities. For instance, if you’re a young professional with no dependents, your insurance needs may be different from someone with a family and mortgage.

3. Research and Compare Policies:

Insurance policies can vary widely in terms of coverage, terms, and premiums. It’s important to shop around and compare policies from different insurance providers. Look for reputable insurers that have a good track record and positive customer reviews. Websites like the National Association of Insurance Commissioners (naic.org) can provide valuable information to help you compare policies.

4. Understand Key Policy Terms:

Insurance policies often come with specific terms and conditions that impact coverage and claims. Take the time to read and understand these key terms, such as deductibles, limits, exclusions, and premiums. Don’t hesitate to ask questions or seek clarification from your insurance provider to ensure you have a clear understanding.

5. Consider the Importance of Deductibles:

A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Generally, higher deductibles result in lower premiums, and vice versa. Consider your financial situation and risk tolerance when deciding on a deductible. If you have sufficient emergency savings, opting for a higher deductible may be a viable option to reduce premium costs.

6. Review and Update Policies Regularly:

Life circumstances change, and so do your insurance needs. Review your policies annually or whenever there are significant changes in your life, such as purchasing a new vehicle, moving to a new home, or experiencing a major life event. This ensures that your coverage remains adequate and up to date.

7. Seek Professional Advice:

Insurance can be complex, and if you find yourself overwhelmed, don’t hesitate to seek professional advice. Insurance brokers or agents can help assess your needs, guide you through the process, and provide expert recommendations tailored to your specific situation.

By understanding the types of insurance, assessing your needs, researching policies, understanding key terms, considering deductibles, reviewing policies regularly, and seeking professional advice when needed, you’ll be well on your way to making informed decisions about insurance. Remember, insurance is an investment in your financial security and peace of mind, so take the time to educate yourself and choose wisely.